#CMCSA (Comcast Corporation). Exchange rate and online charts.

See Also

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1408

Bulls had the upper hand for two weeks, but it's time for a pauseAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

1363

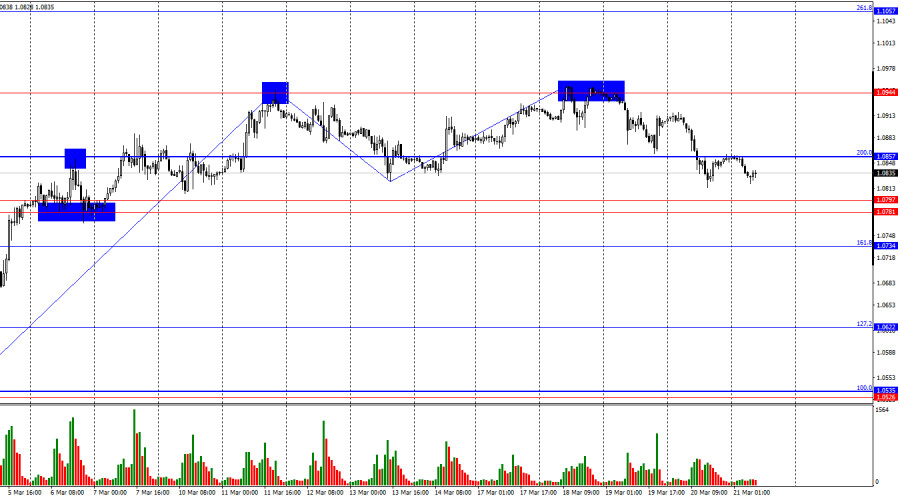

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

1333

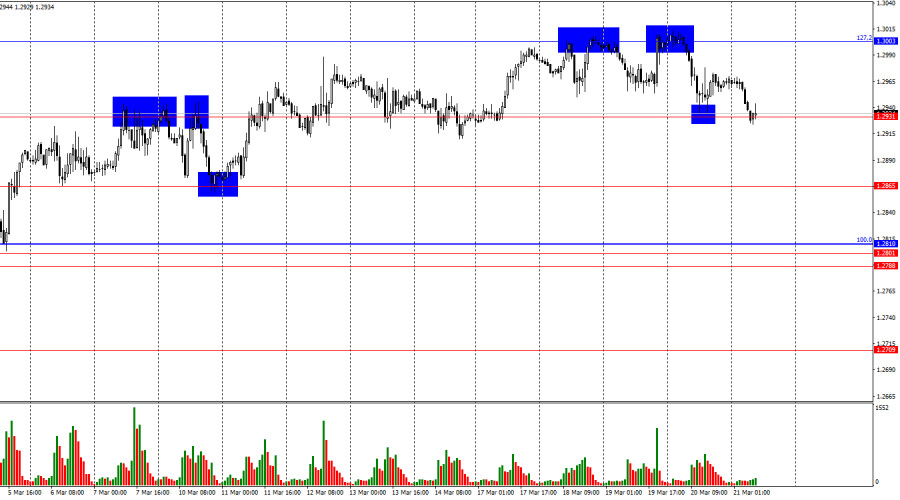

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1303

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

1258

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1183

At the close of yesterday's regular trading session, U.S. stock indices ended in the red. The S&P 500 fell by 0.22%, while the Nasdaq 100 lost 0.33%.Author: Jakub Novak

11:46 2025-03-21 UTC+2

1138

Technical analysis of EUR/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

13:14 2025-03-21 UTC+2

958

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1408

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

1363

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

1333

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1303

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

1258

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1183

- At the close of yesterday's regular trading session, U.S. stock indices ended in the red. The S&P 500 fell by 0.22%, while the Nasdaq 100 lost 0.33%.

Author: Jakub Novak

11:46 2025-03-21 UTC+2

1138

- Technical analysis of EUR/USD, USD/JPY, Gold and Bitcoin.

Author: Sebastian Seliga

13:14 2025-03-21 UTC+2

958