02.02.2024 03:00 PM

02.02.2024 03:00 PMThe current week for Bitcoin is characterized by stabilization, as the cryptocurrency virtually does not react to important macroeconomic events. However, this does not mean that the cryptocurrency is immune to their influence, and the results of the Federal Reserve meeting will be reflected in the future movements of the BTC/USD quotes. At the moment, it can be observed that the bullish momentum that allowed the cryptocurrency to recover above $40k has finally faded. There is now a relative parity between sellers and buyers.

Bitcoin is consolidating and stabilizing near the $43k level, sometimes falling below it and then recovering above. The approaching weekend is expected to exacerbate this trend, but there is every reason to believe that over the weekend or at the beginning of the next trading week, the situation in the Bitcoin market will shift from a standstill. The asset may either resume its upward movement or start another corrective wave. The main catalyst for revitalizing the BTC market will be macroeconomic statistics in the United States.

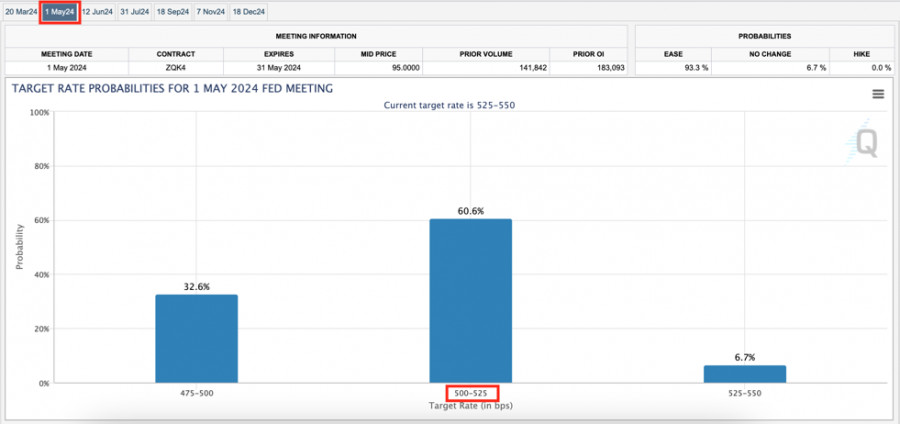

After the Federal Reserve meeting concluded, investors were met with a cold shower as it became evident that the interest rate would not be lowered at the agency's meeting in March. The percentage of investors expecting a decrease fell below 35%, while the majority of investors anticipate another pause. In connection with this, activity in the investment markets significantly decreased, and investors focused their attention on the Federal Reserve meeting in May. Today, important macroeconomic statistics will be released in the United States, which can significantly impact the price movement of BTC in the coming days.

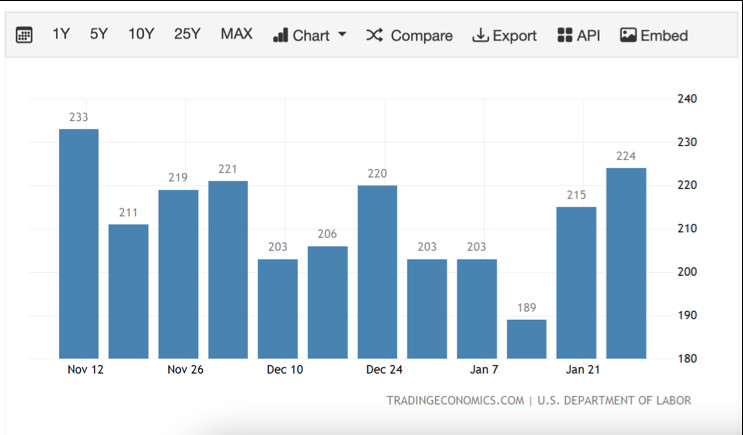

At 13:30 GMT, a report reflecting the change in the employment level in the U.S. for the end of January will be published. This information will help investors form an understanding of the prospects for U.S. economic growth, considering the direct correlation between the employment level and GDP. Investors expect an increase in the U.S. unemployment rate for January to 3.8%, compared to 3.7% in December, which may create grounds for reconsidering the Fed's decision on the possibility of a rate cut.

Furthermore, at 15:00 GMT, investors await data on the Consumer Sentiment Index, which is a leading indicator of inflation. Markets expect that consumer confidence at the end of January will remain at the level of the first two weeks, at 78.9 basis points. In the case of confirmation of the forecast, it would indicate a slowdown in consumer activity and, therefore, a slowdown in the pace of inflation growth. If the macroeconomic data justify investor forecasts, it will significantly increase optimism in financial markets, given the substantial increase in the likelihood of a rate cut as early as the May meeting.

As of February 2, Bitcoin is trading at $43k, with daily trading volumes around $20 billion. There is an activation of miners who have resumed selling BTC stocks, putting pressure on the asset's price. Nevertheless, the cryptocurrency managed to recover above $43k. However, the stochastic oscillator indicates a gradual exit from the overbought zone, which could be a strong sell signal.

With the current situation and the realization of the stochastic signal, the price of Bitcoin will head for a retest of the local support level at $41.9–$42k. If this level is breached, the price will move towards the $40.5k level, a breakdown of which significantly increases the chances of further decline. This, in turn, will lead to a retest of the key support level at $38.6k, where the "shoulders" zone of the large-scale technical analysis figure "Head and Shoulders" is also located. However, this scenario can be avoided by consolidating above $43.8k and continuing the movement towards $45k.

Over the weekend, trading activity for BTC/USD is decreasing, but labor market and consumer confidence macroeconomic data can potentially change this scenario. If the forecasts are justified and the macroeconomic situation in the U.S. deteriorates, the probability of BTC resuming growth and attempting to consolidate above $44k over the weekend or early next week will significantly increase. Strong labor market and consumer activity indicators, on the other hand, can strengthen the U.S. dollar and intensify the correction in the crypto market and Bitcoin.

昨天未能保持在94,000美元以上的嘗試顯示出仍有大量的買盤興趣。儘管昨天歐洲時段的調整可能略微動搖了一些人的信心,但以太坊的表現仍相當穩健。

儘管目前Solana加密貨幣處於強勢狀態,其價格在WMA(30 Shift 2)上方運行,但由於Solana價格走勢與隨機震盪指標之間出現背離,同時隨機指標也處於超買水平(80)以上,並正在準備跌至該水平以下,這些跡象表明在不久的將來,它可能會回調至145.25的水平。然而,只要下跌不跌破並收盤低於141.02的水平,Solana仍有可能再次增強,154.50的水平將嘗試向上突破,如果成功,Solana將繼續強勢至156.51的主要目標,如果增強的波動性和動能支持,159.60將成為下一個目標。

在BTC/USD四小時圖上的波浪圖形變得較為複雜。我們觀察到一個調整的下降結構,其形態在75,000美元附近完成。

比特幣未能保持在94,000美元以上,回調至92,500美元區域,該區域似乎更為穩定。以太坊在短暫突破1,830美元後,也回落至約1,769美元。

比特幣昨日出現強勁上漲。在突破 $90,000 關口後,這一主流加密貨幣漲至 $94,000,其漲勢暫時停滯。

在BTC/USD的4小時圖上的波浪結構相當清晰。在完成一個由五個完整波浪組成的上升趨勢後,下行段開始形成,目前看似是修正。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.