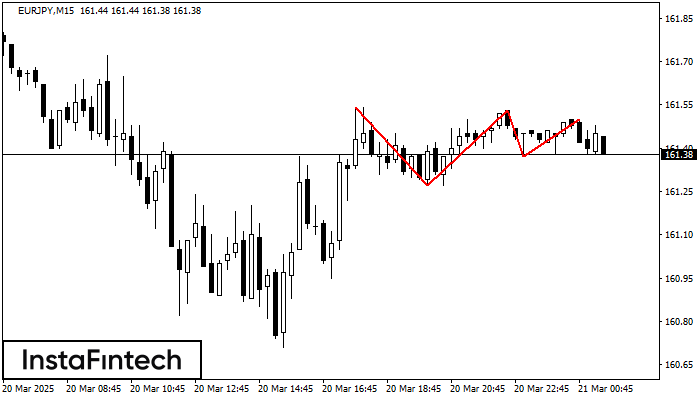

Triple Top

was formed on 21.03 at 01:30:16 (UTC+0)

signal strength 2 of 5

On the chart of the EURJPY M15 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 161.27, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 27 points.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength