USDSGD (US Dollar vs Singapore Dollar). Exchange rate and online charts.

Currency converter

27 Mar 2025 23:42

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/SGD (United States Dollar vs Singapore Dollar)

USD/SGD is involved in active trading on Forex. This currency pair is also called exotic. Rate fluctuations of this trading instrument are not significant. The Singapore dollar is one of the most stable currencies around the world. The economic situation in the country is characterized by very low inflation, robust exports, and huge foreign exchange reserves in the economy.

Singapore is a developed nation with high living standards. Advantageously located at the crossroads of major shipping routes, Singapore has managed to reach such level of development demonstrating an active trading with world's largest economies. At the moment, the country sells abroad home electronics and information technology products, shipbuilding products and financial services. Thus, country's economy and national currency both hinge upon export significantly.

Singapore is listed among the group of so-called "Asian tigers" thanks to the rapid development of its economy. In such a way, the country is approaching to the major Western economies such as the USA, Germany, France, Great Britain, etc.

If you trade USD/SGD, you should pay attention to the dynamics of EUR/USD, GBP/USD, and USD/JPY. These trading instruments are indicators of USD/SGD price movements since they greatly influence the rate of the national currency of Singapore.

If you trade USD/SGD, you should focus on economic indicators of Singapore as well as the global prices for oil and other minerals required to support the Singaporean economy.

See Also

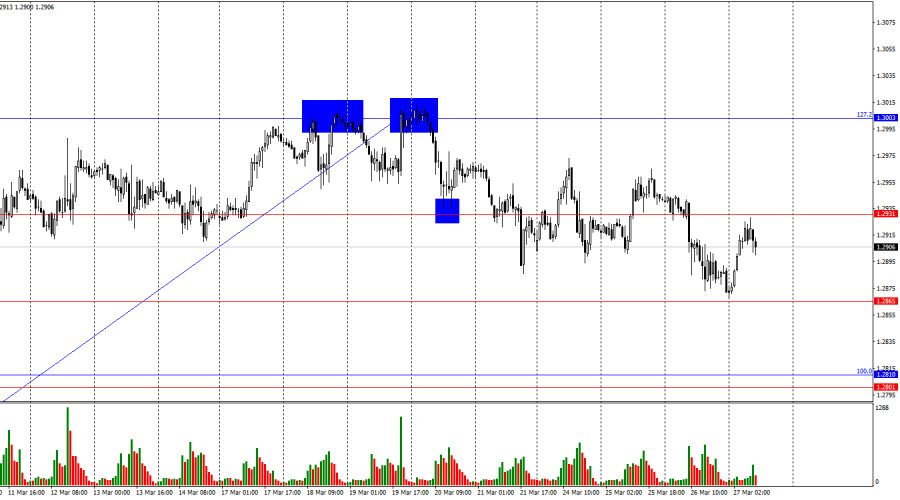

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1543

President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.Author: Gleb Frank

12:15 2025-03-27 UTC+2

1213

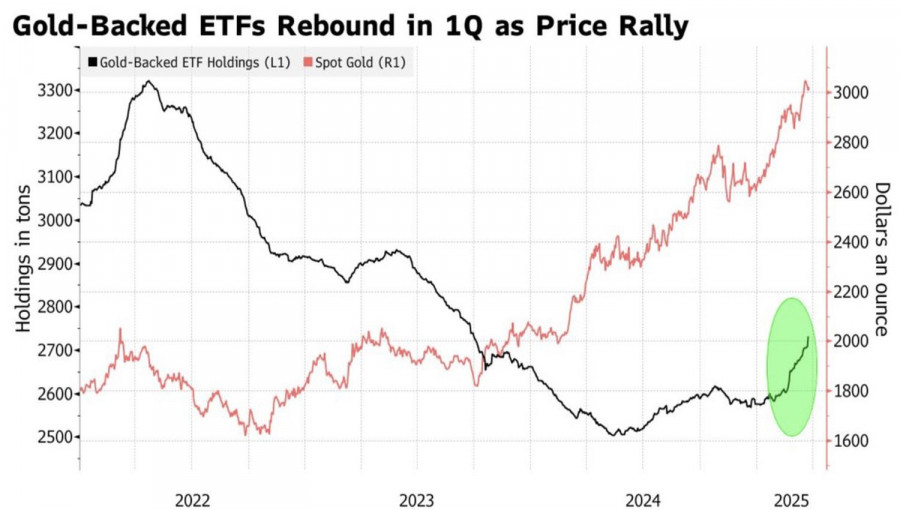

Trade tensions are driving demand for safe-haven assets.Author: Irina Yanina

11:44 2025-03-27 UTC+2

1183

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1183

Fundamental analysisWho Had Any Doubts? Trump Remains Committed to His Economic Course (GBP/USD May Fall, #SPX May Rise)

Despite the ongoing political maneuvering, U.S. President Donald Trump remains committed to his economic strategy. This approach aims to dismantle the long-standing global economic model in which the U.S. primarily produces money while the rest of the world supplies the goodsAuthor: Pati Gani

10:21 2025-03-27 UTC+2

1183

US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and EuropeAuthor: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1138

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1063

Once you understand how the system works, winning isn't hardAuthor: Marek Petkovich

11:55 2025-03-27 UTC+2

1018

The US crypto regulation bill is progressing rapidly through the legislative process.Author: Jakub Novak

11:52 2025-03-27 UTC+2

1018

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1543

- President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.

Author: Gleb Frank

12:15 2025-03-27 UTC+2

1213

- Trade tensions are driving demand for safe-haven assets.

Author: Irina Yanina

11:44 2025-03-27 UTC+2

1183

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1183

- Fundamental analysis

Who Had Any Doubts? Trump Remains Committed to His Economic Course (GBP/USD May Fall, #SPX May Rise)

Despite the ongoing political maneuvering, U.S. President Donald Trump remains committed to his economic strategy. This approach aims to dismantle the long-standing global economic model in which the U.S. primarily produces money while the rest of the world supplies the goodsAuthor: Pati Gani

10:21 2025-03-27 UTC+2

1183

- US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and Europe

Author: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1138

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1063

- Once you understand how the system works, winning isn't hard

Author: Marek Petkovich

11:55 2025-03-27 UTC+2

1018

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

1018