See also

18.07.2024 09:50 AM

18.07.2024 09:50 AMThe UK inflation data was published on Wednesday, with the rate flatline at 2%, the lowest level since 2021. However, economists had mostly expected a drop to 1.9%.

The euro area inflation data was also published on the same day. The final figures matched the preliminary estimate, so the market did not react to this report.

During the US trading session, industrial production data was released, which showed that the growth rate in the United States accelerated from 0.3% to 1.6%, against an expectation of a rise to 0.4%.

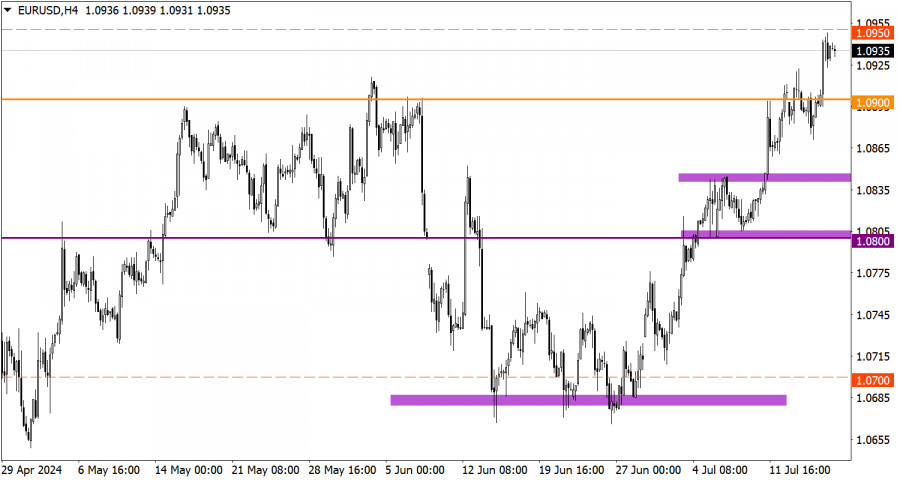

The EUR/USD pair, whose long positions have strengthened and has settled above the 1.0900 level, has moved towards the main psychological level of 1.1000.

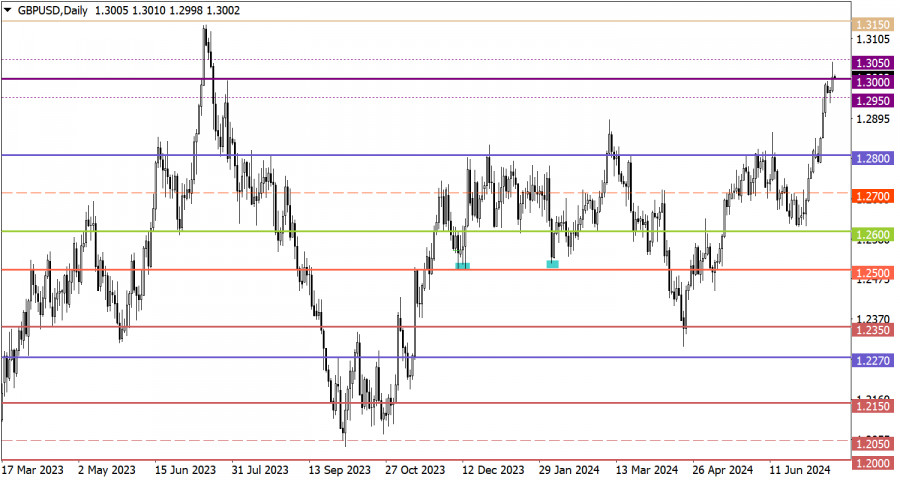

The GBP/USD pair is also showing a bullish trend, confirmed by the impulsive move above the 1.3000 level.

Today, market participants will focus on the European Central Bank's policy meeting. Interest rates are expected to remain unchanged. Given the inflation dynamics and extremely weak macroeconomic data, ECB President Christine Lagarde may hint at a more active easing of monetary policy. This could indicate a further increase in the interest rate disparity between the dollar and the euro in favor of the dollar, and as a result, the US currency may pull back to the levels seen at the start of yesterday's trading.

In case the pair rises further, the quote may reach the psychological level of 1.1000. However, it is important to consider the euro's overbought status, which does not rule out the possibility of a pullback or stagnation within this level, especially given today's information-rich backdrop. An increase in buying volumes may take place after the price settles above the 1.1050 level.

For the next stage of growth in the pound sterling's rate, it is necessary for the price to settle above the 1.3050 level. Otherwise, we can expect the pair to fluctuate within the range of the psychological levels of 1.2950-1.3050.

Candlestick Chart - This consists of rectangles in white and black with lines on the top and bottom. By analyzing each individual candlestick in detail, you can see its characteristics relative to a specific time period: opening price, closing price, highest price, and lowest price.

Horizontal Levels - These are price coordinates at which a price stop or reversal may occur. In the market, these levels are called support and resistance.

Circles and Rectangles - These are highlighted examples where the price has historically reversed. This color highlighting indicates horizontal lines that may exert pressure on the quote in the future.

Up/Down Arrows - These indicate possible future price directions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Tuesday, the GBP/USD currency pair showed very low volatility and a general lack of interest in trading. While the euro traded with a noticeable decline, the British pound mostly

The EUR/USD currency pair traded lower on Tuesday. Once again, volatility was far from low, which might suggest the presence of significant events or news during the day. However, there

In my morning forecast, I highlighted the 1.1485 level as a key decision point for market entry. Let's look at the 5-minute chart and examine what happened. The pair dipped

Analysis of Monday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade with substantial gains throughout Monday. On the first trading day of the week, there were

Analysis of Monday's Trades 1H Chart of EUR/USD The EUR/USD currency pair started Monday with a sharp rally. Overnight, the euro appreciated by 100–120 pips, and the pair traded more

The GBP/USD currency pair continued its upward movement on Monday as it did last week. The only difference was the strength of the movement. On Monday, volatility was very high—without

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.