See also

06.02.2025 12:45 AM

06.02.2025 12:45 AMThe last major correction of the S&P 500 occurred from January to November 2022, primarily due to a significant shift in Federal Reserve policy. In response to rising inflation concerns, the Fed increased interest rates from 0.25% to 5.50% over eight months, causing capital to flow out of equities and into the bond market. Currently, the situation is fundamentally different—the market has adjusted to high interest rates, which are no longer a limiting factor. While the Fed is expected to continue lowering rates, albeit gradually, this is no longer the main focus. Instead, attention has turned to the protectionist policies of the U.S. administration.

If the countries initially targeted by the new tariff policy—Mexico, Canada, and China—had responded with countermeasures similar to those imposed by the U.S., it could have triggered a global stock market decline due to fears of a worldwide trade war. This potential scenario unfolded within the first 24 hours following the announcement of the executive orders. However, it quickly became clear that no one was eager to engage in a global confrontation. The implementation of new tariffs has been postponed for a month, during which U.S. trading partners will seek to mitigate the impact through negotiations. This represents a temporary victory for Trump and his administration.

The ultimate goal of the new customs policy is twofold: to stimulate domestic producers, whose products will become relatively cheaper compared to imports, and to encourage the relocation of manufacturing to the U.S. as tariffed countries lose revenue and, from a financial perspective, reduce their competitiveness.

Overall, the situation appears positive regarding capital flows. The dollar is unlikely to undergo a significant correction, and companies in the energy and financial sectors may experience new growth momentum, which will bolster the stock market overall.

We expect that the measures being implemented by the Trump administration will lead to increased capital inflow into the U.S. market. Companies that are foundational to the S&P 500 will gain a competitive advantage, which will be reflected in the index's overall growth.

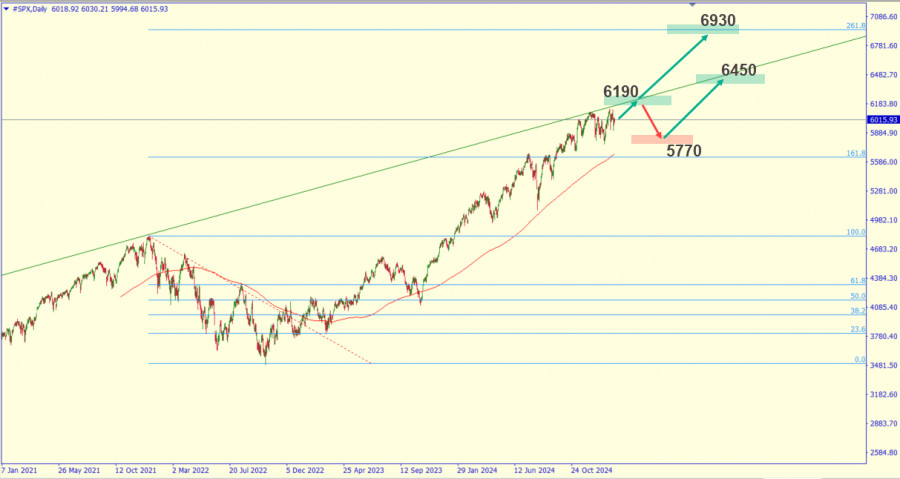

In our view, the S&P 500 is expected to continue rising, with the next target set at 6,190. If the U.S. fully implements the proposed measures, the index could potentially reach a long-term target of 6,930, which currently appears ambitious. The coming month will reveal how far other countries are willing to go to defend their national interests. If they demonstrate significant resistance, a corrective pullback could be substantial, with support anticipated at the 5,770 level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euro

The total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.