See also

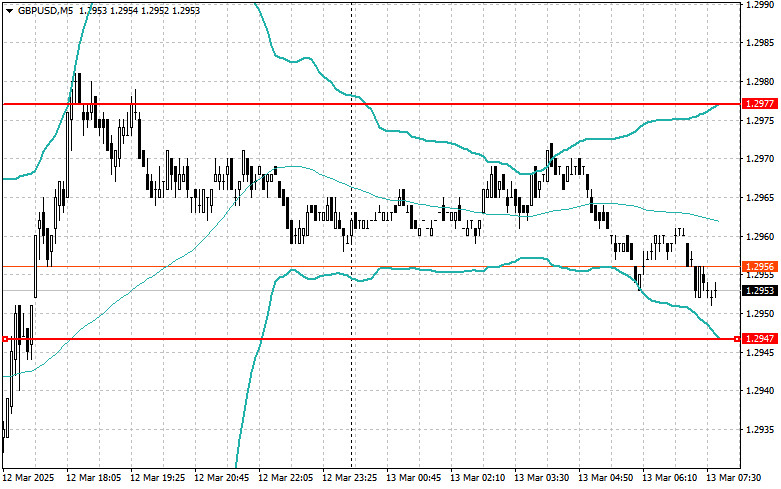

The pound continues to reach new highs, but there are concerns regarding the euro, especially after recent comments made by European Central Bank President Christine Lagarde. Despite her statements, which should have supported the currency, the euro has not reacted positively.

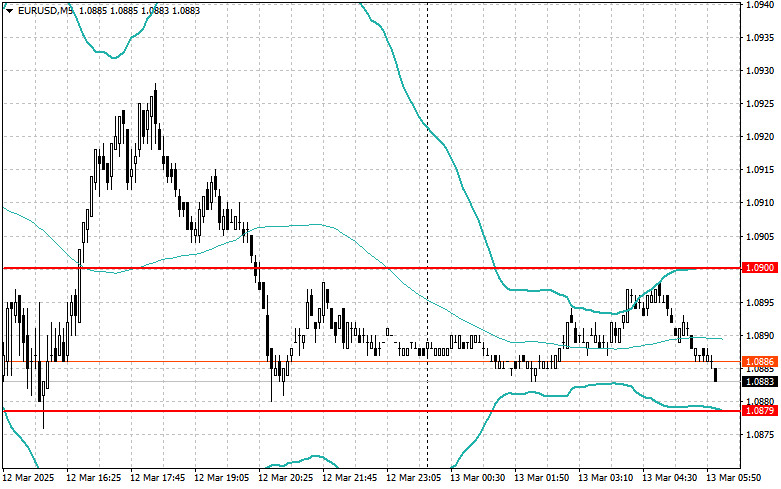

Lagarde noted that the eurozone economy is facing exceptional shocks related to trade, defense, and climate issues. These could lead to increased inflation volatility and raise the risk of prolonged price growth. This implies a more cautious approach to lowering interest rates in the future. However, as indicated on the chart, the euro has largely disregarded these remarks.

In contrast, recent U.S. inflation data raises doubts about the possibility of maintaining current interest rates, which should have weakened the dollar and bolstered confidence in the euro, but that did not occur.

Today, we can expect data from the eurozone's industrial sector and Italy's quarterly unemployment rate. This leaves little room for the euro to gain support. Traders are likely to take a wait-and-see approach, carefully analyzing the new data and considering its potential impact on the ECB's monetary policy.

These factors may be further compounded by overall instability in global markets, driven by geopolitical tensions and concerns about slowing economic growth worldwide.

If the data aligns with economists' expectations, it is advisable to use a Mean Reversion strategy. In contrast, if the data greatly exceeds or falls short of expectations, the Momentum strategy is recommended.

Buying above 1.0917 could push the euro toward 1.0950 and 1.0979.

Selling below 1.0877 could lead to a decline toward 1.0842 and 1.0807.

Buying above 1.2970 could push the pound toward 1.3010 and 1.3040.

Selling below 1.2949 could lead to a decline toward 1.2914 and 1.2875.

Buying above 147.84 could push the dollar toward 148.20 and 148.58.

Selling below 147.65 could lead to a decline toward 147.30 and 146.78.

I will look for selling opportunities if the price fails to break above 1.0900 and returns below this level.

I will look for buying opportunities if the price fails to break below 1.0879 and returns above this level.

I will look for selling opportunities if the price fails to break above 1.2977 and returns below this level.

I will look for buying opportunities if the price fails to break below 1.2947 and returns above this level.

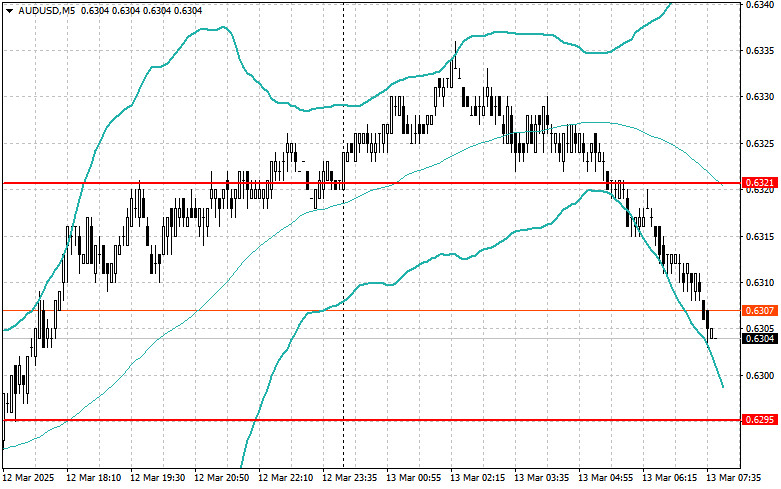

I will look for selling opportunities if the price fails to break above 0.6321 and returns below this level.

I will look for buying opportunities if the price fails to break below 0.6295 and returns above this level.

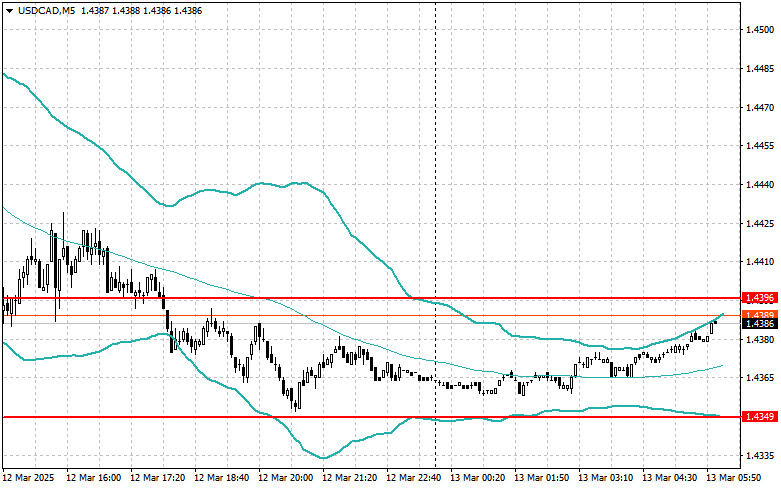

I will look for selling opportunities if the price fails to break above 1.4396 and returns below this level.

I will look for buying opportunities if the price fails to break below 1.4349 and returns above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.