See also

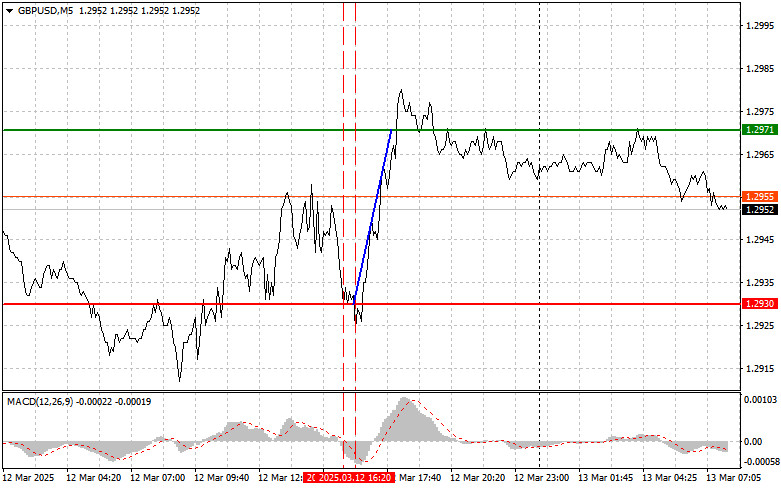

The initial price test at 1.2930 occurred when the MACD indicator had dropped significantly below the zero mark, which limited the downside potential of the pair. For this reason, I decided not to sell the pound. Shortly after, the second test of 1.2930 took place when the MACD was in the oversold area. This allowed for the second scenario to unfold, leading to a 40-pip rise in the pound.

According to data released yesterday, the U.S. Consumer Price Index rose by only 0.2% in February, following a sharp 0.5% increase in January. This slower inflation growth weakened the dollar by increasing the likelihood of the Federal Reserve lowering interest rates in the near future, which triggered new purchases of the British pound. This moderate increase in inflation may encourage the Fed to continue cutting rates, further weakening the dollar and sustaining the bullish trend in GBP/USD. However, it is essential to recognize that the Fed's decisions are influenced by multiple factors beyond a single inflation report. The resilience of the labor market, the global economic situation, and geopolitical risks also play crucial roles. Therefore, it is premature to assume that rate cuts are unavoidable.

Today, there are no significant economic reports scheduled for the UK, so we can expect the pound's growth in the ongoing uptrend to continue.

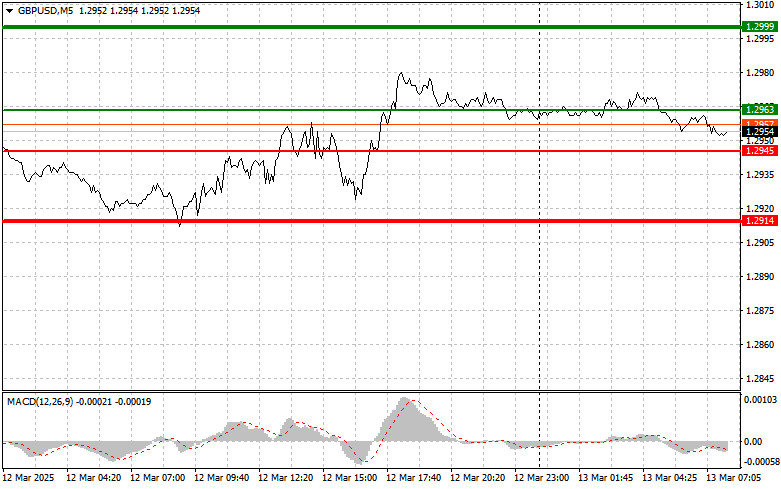

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Scenario #1: Today, I plan to buy the pound when the entry point reaches around 1.2963 (green line on the chart), aiming for a rise to 1.2999 (thicker green line on the chart). Around 1.2999, I plan to exit my buy positions and open sell trades in the opposite direction, expecting a movement of 30-35 pips back from the level. A further rise in the pound can be expected as part of the ongoing uptrend. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I plan to buy the pound today if the price tests 1.2945 twice a row while the MACD is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.2963 and 1.2999 can be expected.

Scenario #1: Today, I plan to sell the pound after the price breaks below 1.2945 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 1.2914, where I plan to exit my sell trades and immediately open buy positions in the opposite direction, expecting a movement of 20-25 pips back from the level. It is better to sell the pound at the highest possible levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound today if the price tests 1.2963 twice in a row while the MACD is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline to the opposite levels of 1.2945 and 1.2914 can be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.