See also

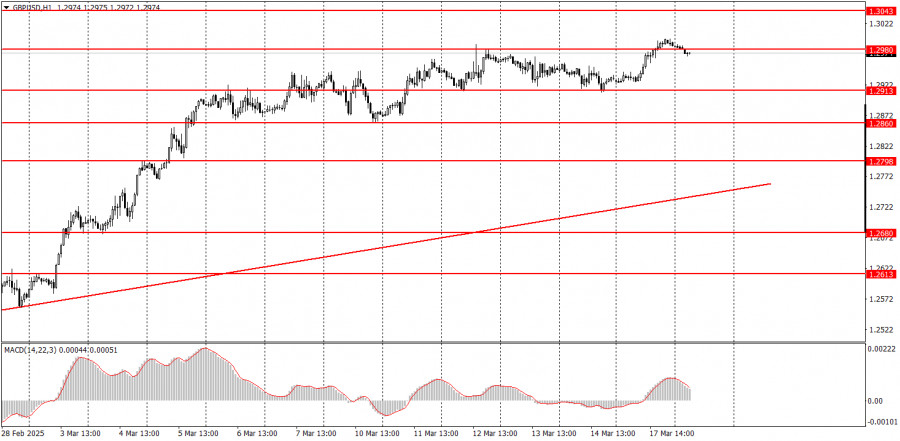

On Monday, the GBP/USD pair also attempted to resume its upward movement and even broke through the latest local high within the current uptrend on the hourly timeframe. The fact that there were no fundamental reasons for a new increase in the pound is no longer surprising. The U.S. retail sales report was not very strong, but the U.S. dollar had already fallen before its release. In general, the dollar has been declining almost every day. After a sharp drop a couple of weeks ago, the U.S. currency has been unable to correct upwards. The movement in the pound is now purely momentum-driven, and the macroeconomic and fundamental background has virtually no significance for market participants. The ascending trendline continues to signal an uptrend, but in the long term, the downtrend persists.

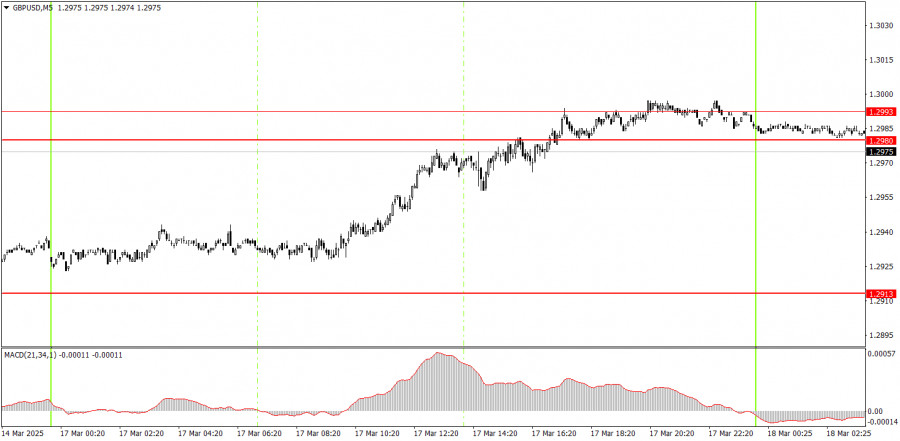

No clear trading signals were formed on Monday in the 5-minute timeframe. Unfortunately, before starting its next rally, the pound did not generate a buy signal. By the evening, the price reached the 1.2980-1.2991 area, where no rebound or breakout had yet formed. If one of these signals forms today, positions can be opened accordingly.

On the hourly timeframe, the GBP/USD pair should have started a downtrend long ago, but Trump is doing everything possible to prevent this from happening. In the medium term, we still expect a decline in the pound towards 1.1800, but it remains unclear how long the dollar will continue falling due to Trump. When this movement ends, the technical picture on all timeframes may change drastically, but long-term trends are still pointing south. The pound has risen not without reason but again too strongly and illogically.

On Tuesday, the GBP/USD pair may continue its growth since the market does not need any reasons or justification to sell the dollar. A downward correction is overdue, but the market is not inclined to buy the dollar.

On the 5-minute timeframe, trading can be based on the following levels: 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, and 1.3102-1.3107. No significant events or reports are scheduled for Tuesday in the UK, while the U.S. will release several less important reports, the most interesting being industrial production data.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.