See also

18.03.2025 11:36 AM

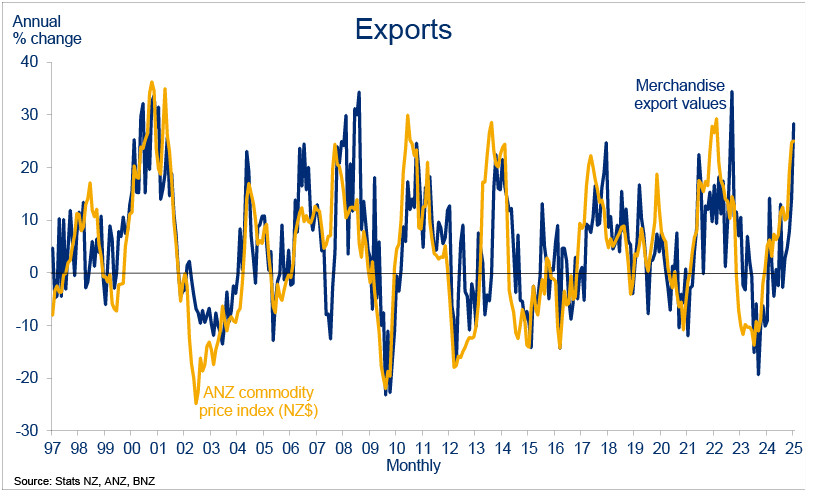

18.03.2025 11:36 AMThe New Zealand dollar (NZD) has gained another strong bullish factor as the ANX Commodity Price Index recorded another solid increase in February, rising 3.0% month-on-month (m/m) and 14% year-on-year (y/y). If the trade war bypasses New Zealand, the country's trade balance will remain consistently in surplus, helping to stabilize the domestic economy faster and return to a growth trajectory.

Market participants interpreted the latest economic data positively, making the Kiwi the best-performing major currency on Monday.

The rally was supported by upbeat economic data from China, where retail sales, industrial production, and fixed asset investment all exceeded forecasts. Another positive factor for NZD is the broad increase in risk appetite, as the potential for de-escalating geopolitical tensions has emerged.

On Wednesday evening, the final Q4 GDP report will be released, with the primary focus on private consumption trends, as this indicator reflects the recovery of consumer demand. If the data meets or exceeds expectations, NZD could receive another bullish signal.

Following the resignation of Adrian Orr as RBNZ Governor, the Reserve Bank of New Zealand is expected to take a more cautious, conservative approach, which is also supportive of the Kiwi—a potential rate cut may slow down. Overall, NZD has a chance to take advantage of favorable market conditions and continue its upward momentum.

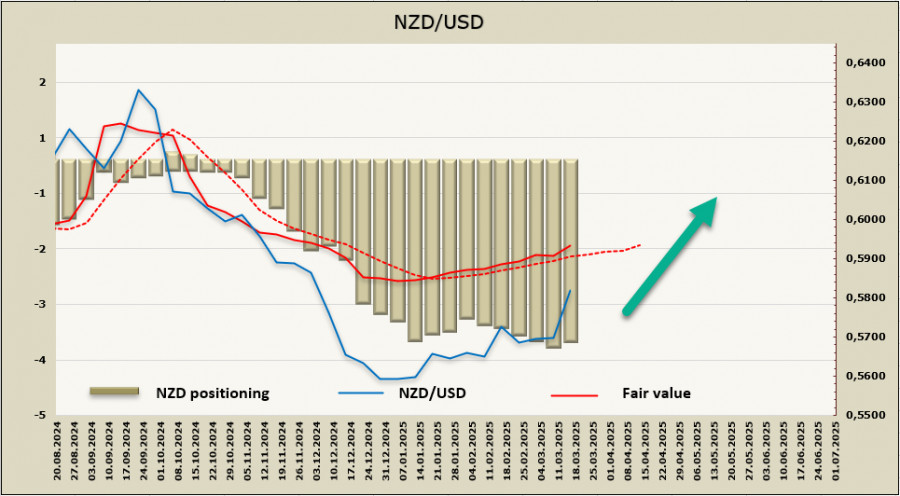

Speculative positioning remains bearish, but the net short position on NZD slightly decreased by $134 million to -$3.026 billion over the reporting week. Short-term factors continue to support the Kiwi's rally, and the fair value estimate has accelerated upward.

Technical Outlook for NZD/USD

NZD/USD is attempting to extend its corrective rally, fueled by positive external factors, and has approached key technical resistance at 0.5839. A break above this level is likely, as this scenario appears more probable than another downside retracement.

The next resistance zone and upside target lies at 0.5920/40, but further gains depend on a combination of factors, primarily continued demand for risk assets.

Key support is at 0.5768, and any pullback to this level could be used as a buying opportunity. While the bullish momentum remains intact, it is driven primarily by external factors, meaning the duration of NZD/USD's rally will depend on how long the favorable external environment persists.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euro

The total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.