See also

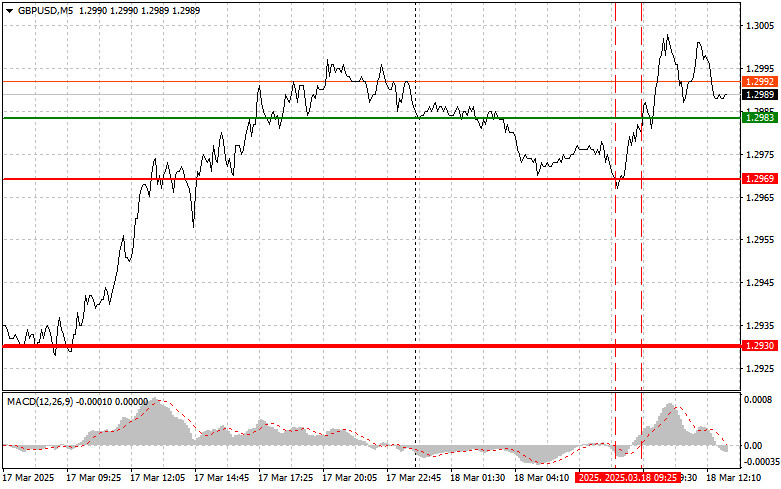

The test of the 1.2983 price level occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound. A similar situation occurred with selling at 1.2969, where the MACD had already moved significantly downward, limiting the pair's decline.

During the U.S. session, several key economic reports will be released. Housing market data will help investors assess the current state of the U.S. economy. Building permits and housing starts are considered leading indicators of housing sector activity, which in turn is a crucial component of economic growth.

An increase in permits and housing starts may signal that developers are confident in future housing demand, which is generally a positive economic signal that supports the U.S. dollar. Conversely, a decline in these indicators could suggest a slowdown in housing activity, potentially indicating broader economic weakening, which could lead to another GBP/USD rally.

Additionally, the U.S. industrial production report will be another key indicator, reflecting the manufacturing sector's performance. An increase in industrial production typically suggests rising demand for goods and services, which fuels economic growth. However, only very strong data will lead to a strengthening of the dollar and a decline in GBP/USD.

Regarding intraday trading strategy, I will focus on Scenario #1 and Scenario #2.

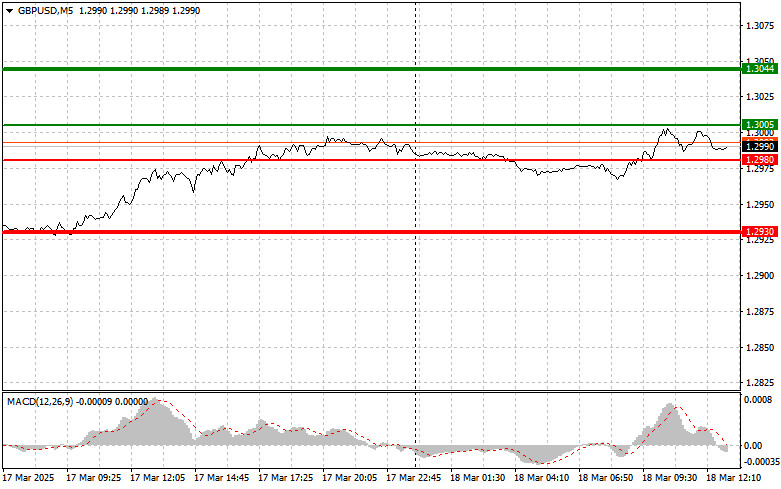

Scenario #1: I plan to buy the pound today at 1.3005 (green line on the chart) with a target of 1.3044. At 1.3044, I will exit my buy position and sell GBP/USD for a 30-35 point pullback. Expecting the pound to rise today as part of the uptrend. Important: Before buying, ensure the MACD indicator is above zero and just starting to rise.

Scenario #2: I also plan to buy GBP/USD today if the price tests 1.2980 twice, while MACD is in the oversold area. This will limit the pair's downward potential and trigger a reversal to the upside, targeting 1.3005 and 1.3044.

Scenario #1: I plan to sell GBP/USD after reaching 1.2980 (red line on the chart), expecting a quick decline. The main target for sellers will be 1.2930, where I will exit my sell position and buy GBP/USD immediately for a 20-25 point pullback. Selling pressure may increase if U.S. data is strong. Important: Before selling, ensure the MACD indicator is below zero and just starting to decline.

Scenario #2: I also plan to sell GBP/USD today if the price tests 1.3005 twice, while MACD is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward, targeting 1.2980 and 1.2930.

Forex trading requires careful decision-making. It is best to stay out of the market before major fundamental reports to avoid unexpected price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you risk losing your entire deposit quickly, especially if you trade with large volumes and do not follow risk management rules.

For successful trading, you need a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.