See also

19.03.2025 10:41 AM

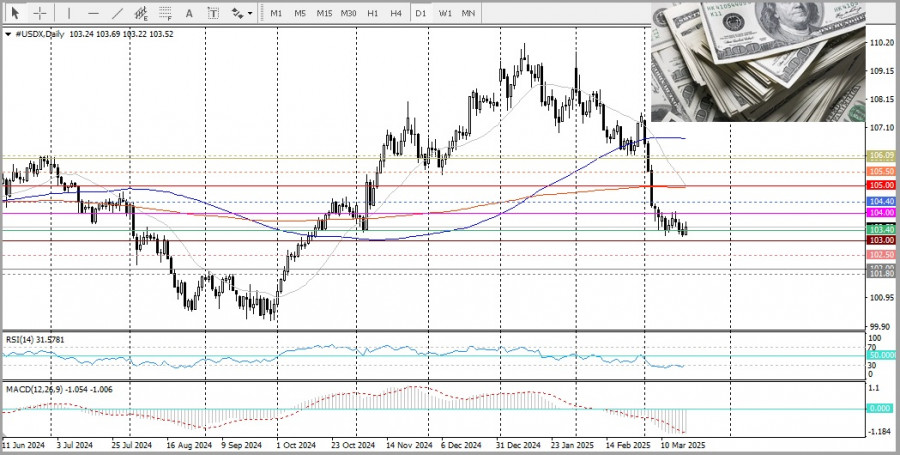

19.03.2025 10:41 AMGold has halted its upward movement as it attempts to consolidate at new all-time highs around $3,045, with bulls taking a pause ahead of the FOMC meeting results. The Federal Reserve is expected to keep interest rates unchanged within the 4.25% - 4.50% range, which could have a significant impact on the U.S. dollar's price action and, consequently, on gold. Given expectations that rates will remain unchanged, the focus shifts to the updated economic projections and Fed Chair Jerome Powell's comments during the post-meeting press conference. His remarks may provide clues regarding the future path of rate cuts, influencing the U.S. dollar's trajectory and potentially giving gold a new directional impulse.

If the Federal Reserve signals a potential rate cut, this could support gold prices at elevated levels, as the precious metal is traditionally seen as a safe-haven asset during periods of economic uncertainty.

However, today's strengthening U.S. dollar may limit gold's upward potential, especially amid concerns over trade policy and geopolitical tensions.

From a technical perspective, the market is showing signs of overbought conditions, as indicated by the Relative Strength Index (RSI) above 70. This may prompt traders to exercise caution, waiting for a consolidation phase or a pullback before opening new long positions.

If a correction occurs, support levels around $3,005–$3,000 could provide buying opportunities, with additional support near $2,980–$2,978. A break below these levels could trigger further declines toward $2,956 and even $2,930, before gold potentially retests the $2,900 level, which marked last week's swing lows.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Only one macroeconomic release is scheduled for Wednesday — Germany's industrial production data. We believe that most traders already understand that this report, even if it generates a short-term reaction

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.