See also

21.03.2025 12:46 AM

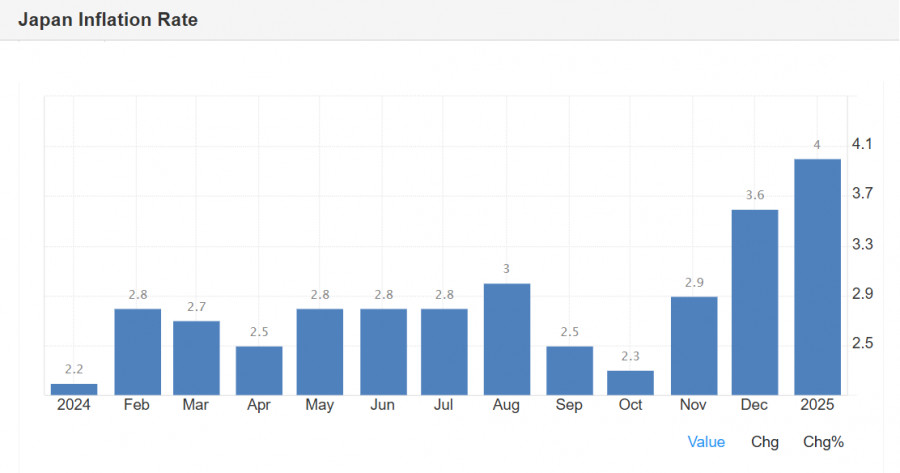

21.03.2025 12:46 AMThe Bank of Japan (BoJ) kept interest rates unchanged on Wednesday, and the market reacted neutrally, as this outcome was widely expected. BoJ Governor Kazuo Ueda stated that the risk of rising core inflation remains as wage growth and food prices remain elevated. Inflation data for February will be released overnight, and so far, the trend clearly favors further increases.

This marks the third consecutive BoJ meeting in which the interest rate has remained unchanged. In January, expectations were that the BoJ would raise rates in March, but the new U.S. president's announcement of a tariff review on imports increased uncertainty, leading to another pause—an outcome that was largely anticipated.

Japan is closely monitoring U.S. trade policy changes, with an expected announcement on April 2 regarding tariff increases on automobiles. The United States is Japan's largest export market (over $140 billion), with automobiles accounting for 28% of total exports. Japan fears it may become the next target of trade restrictions, as surveys indicate that business sentiment among manufacturers deteriorated in March.

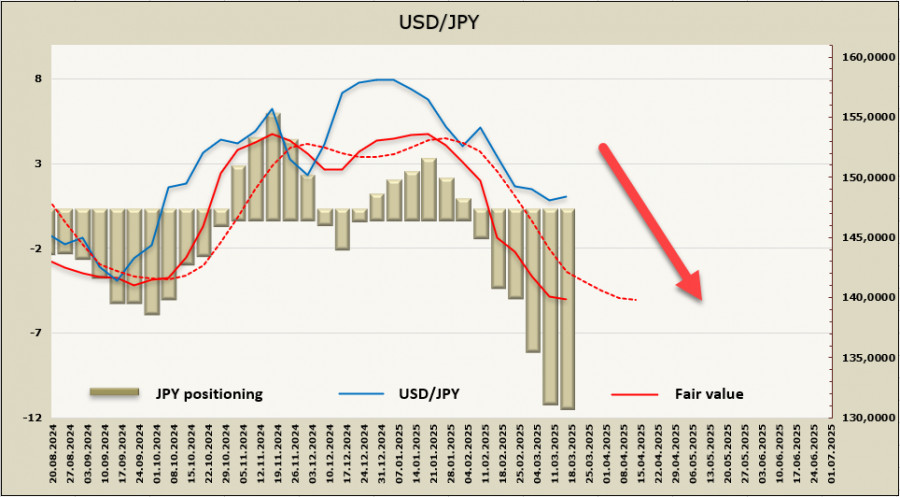

Domestic wage growth is the second key factor influencing the BoJ's position, as it plays a crucial role in consumer demand and inflation. On Friday, the Japanese Trade Union Confederation (Rengo) announced that it had secured an average wage increase of 5.46%, exceeding last year's figures and marking the largest gain in 30 years. If these numbers are confirmed, expectations for a BoJ rate hike in May will strengthen, further boosting the yen. Current forecasts suggest that the BoJ will raise rates to 0.75% at one of its upcoming meetings, most likely in July, but now the market is increasingly considering the possibility of an earlier hike. Since the Federal Reserve is cutting rates, the trajectory for USD/JPY is quite clear.

Net long positions on the yen have reached $11.3 billion, the strongest speculative bet against the U.S. dollar among G10 currencies. Despite minimal changes in positioning over the past week, bullish momentum for the yen remains strong, and the estimated fair value of USD/JPY continues to decline.

After forming a local low at 146.50, USD/JPY rebounded slightly but remained within a bearish channel, with little reason to expect sustained growth. There was some speculation that the Bank of Canada might opt for another rate hike, but this did not materialize, and it has not changed the overall market sentiment—the yen is expected to continue strengthening.

Currently, the BoJ is the only major central bank tightening monetary policy, while others are shifting toward easing. We see a high probability of USD/JPY breaking below 146.50 and moving toward the long-term target of 139.59. The only potential disruption to this scenario would be a sharp increase in U.S. inflation expectations, which could alter the FOMC's rate outlook—but for now, there are no signs of such a shift.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euro

The total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.