See also

11.04.2025 07:55 AM

11.04.2025 07:55 AMThe euro and the pound soared after reports revealed that U.S. inflation dropped significantly in March this year.

The U.S. Consumer Price Index (CPI) declined in March compared to February, contrary to economists' expectations of an increase. This significantly weakened the U.S. dollar. The unexpected deflationary trend sparked discussions in financial circles, prompting traders to revise their forecasts regarding the Federal Reserve's future monetary policy. Lower inflation may push the Fed toward a more proactive stance on cutting interest rates, which, in turn, would make the dollar less attractive to yield-seeking investors. However, some experts caution against hasty conclusions, noting that one month of data is insufficient to confirm a sustainable trend—especially under the current trade tariffs recently introduced by Trump.

It's important to remember that Trump has only suspended 20% of tariffs for 90 days. The 10% tariffs previously imposed remain entirely in effect.

Today may bring further gains for the euro, fueled by data showing an increase in both the Consumer Price Index and the Harmonized Index of Consumer Prices for Germany, calculated to EU standards. The Eurogroup meeting will also attract market participants' attention.

The Eurogroup meeting, where finance ministers from eurozone countries will discuss the economic outlook and agree on policy measures, could influence the euro's behavior. Comments from meeting participants regarding economic prospects and fiscal strategy will provide investors with clues about the euro's future. Positive signals could give the single currency additional momentum.

The British pound may strengthen due to positive UK GDP data, industrial production, and a favorable trade balance.

The Mean Reversion strategy is preferred if the data matches economists' expectations. The Momentum strategy is more appropriate if the data significantly exceeds or falls short of expectations.

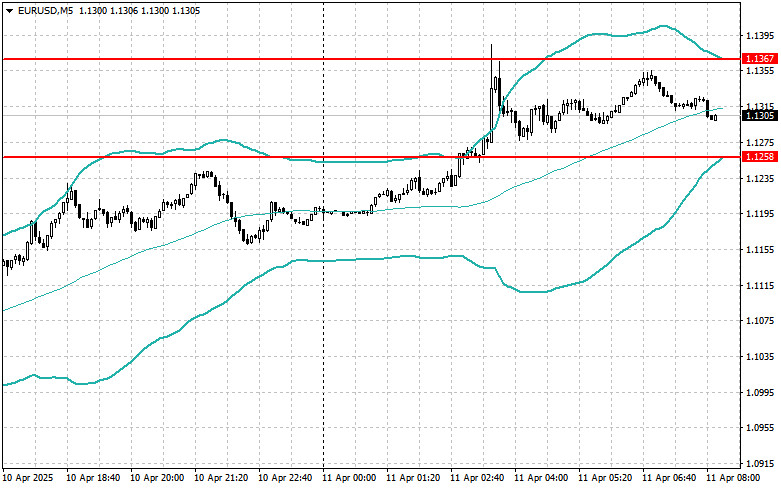

Buying on a breakout above 1.1310 may lead to a rise in the euro toward the 1.1350 and 1.1427 areas.

Selling on a breakout below 1.1270 may lead to a drop in the euro toward the 1.1217 and 1.1155 areas.

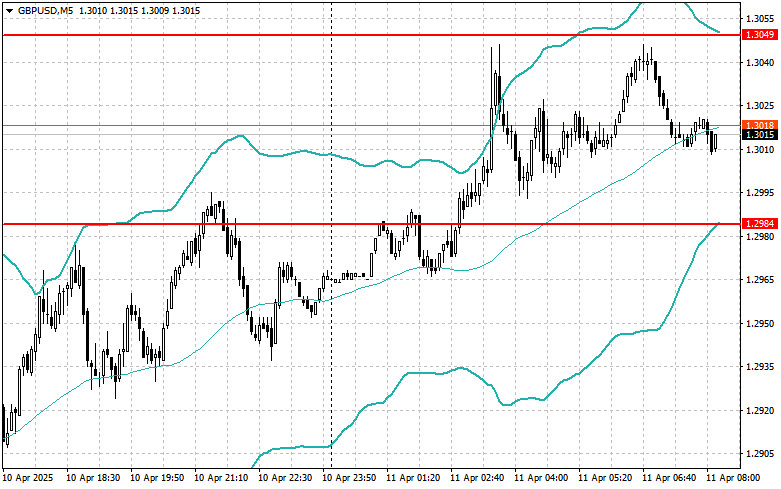

Buying on a breakout above 1.3020 may lead to a rise in the pound toward the 1.3050 and 1.3108 areas.

Selling on a breakout below 1.2985 may lead to a drop in the pound toward the 1.2929 and 1.2866 areas.

Buying on a breakout above 143.77 may lead to a rise in the dollar toward the 144.17 and 144.51 areas.

Selling on a breakout below 143.29 may lead to dollar sell-offs toward the 142.86 and 142.33 areas.

I will look to sell after a failed breakout above 1.1367, upon a return below this level.

I will look to buy after a failed breakout below 1.1258, upon a return above this level.

I will look to sell after a failed breakout above 1.3049, upon a return below this level.

I will look to buy after a failed breakout below 1.2984, upon a return above this level.

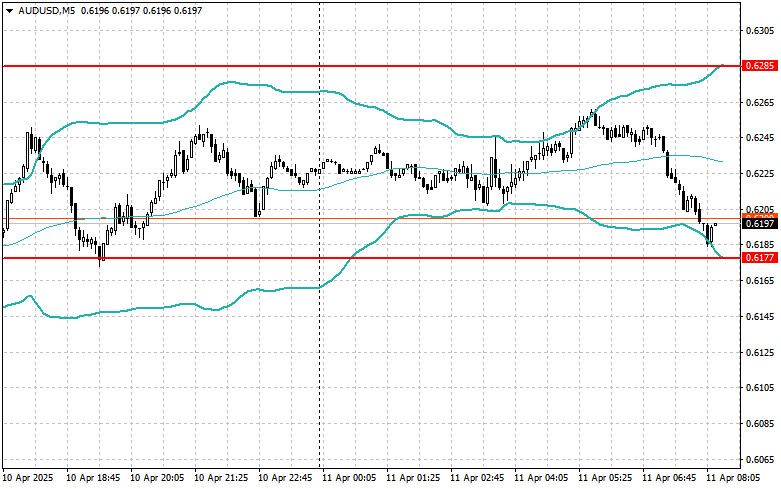

I will look to sell after a failed breakout above 0.6285, upon a return below this level.

I will look to buy after a failed breakout below 0.6177, upon a return above this level.

I will look to sell after a failed breakout above 1.3990, upon a return below this level.

I will look to buy after a failed breakout below 1.3893, upon a return above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 140.68 occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the pair's upside potential. For this reason

The test of the 1.3356 price level coincided with the moment when the MACD indicator had just started moving downward from the zero mark, confirming a correct entry point

The test of the 1.1460 price level in the second half of the day coincided with the MACD indicator starting to move downward from the zero line, confirming the correct

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.