See also

11.04.2025 06:18 PM

11.04.2025 06:18 PMTo Open Long Positions on GBP/USD:

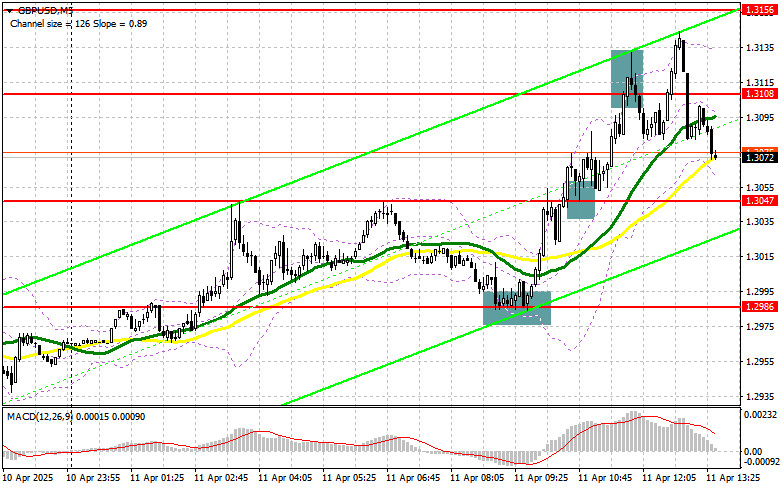

Strong UK GDP data triggered another wave of pound appreciation. During the U.S. session, news of a decline in the U.S. Producer Price Index (PPI) for March and weak results from the University of Michigan Consumer Sentiment Index could prompt new buying of the pound. However, considering the substantial rise earlier in the day, it's best to act on pullbacks.

A false breakout around the support at 1.3057 will offer a good entry point for long positions targeting a rebound toward the resistance at 1.3139. A breakout and retest of this range from top to bottom will provide another entry signal for long positions, with the prospect of updating 1.3204, potentially forming a new bullish market. The ultimate target will be the 1.3262 zone, where I plan to lock in profits.

If GBP/USD declines and there's no buyer activity at 1.3057 in the second half of the day, pressure on the pair may return by the end of the week. In this case, only a false breakout around 1.2986 would offer a proper buying condition. I also plan to open long positions immediately on a rebound from 1.2929, aiming for a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers attempted to make a move, but the solid fundamental backdrop continues to support the pound. If GBP/USD rises again during the U.S. session after comments from Fed officials and U.S. inflation data, a false breakout around 1.3139 will provide an entry point for short positions, targeting a drop to the new support at 1.3057. A breakout and retest of this level from below will trigger stop-loss orders and open the path toward 1.2986, where the moving averages lie, currently favoring the bulls. The ultimate target will be 1.2929, where I will take profits.

If demand for the pound holds in the second half of the day and bears remain inactive around 1.3139, it's better to delay selling until a test of resistance at 1.3204. I will sell there only after an unsuccessful consolidation. If there is no downward movement there either, I'll look for short entries around 1.3262, solely expecting a 30–35 point intraday correction.

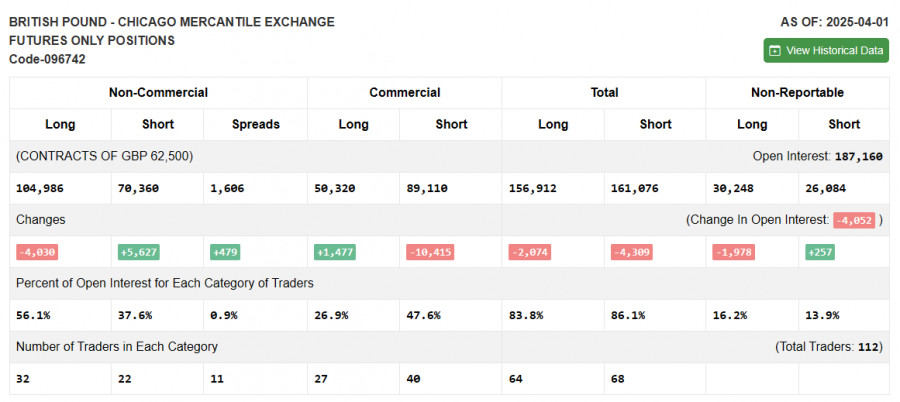

COT (Commitment of Traders) Report:

The COT report for April 1 showed a small increase in short positions and a reduction in long ones. It's important to note that the report does not reflect the recent U.S. trade tariffs imposed on key economic partners, including the UK, nor the latest March U.S. employment data. Therefore, detailed analysis of the figures is not meaningful as they don't reflect the current market situation.

According to the report, long non-commercial positions fell by 4,030 to 104,986 and short non-commercial positions rose by 5,627 to 64,733. The net position gap increased by 479.

Indicator Signals:

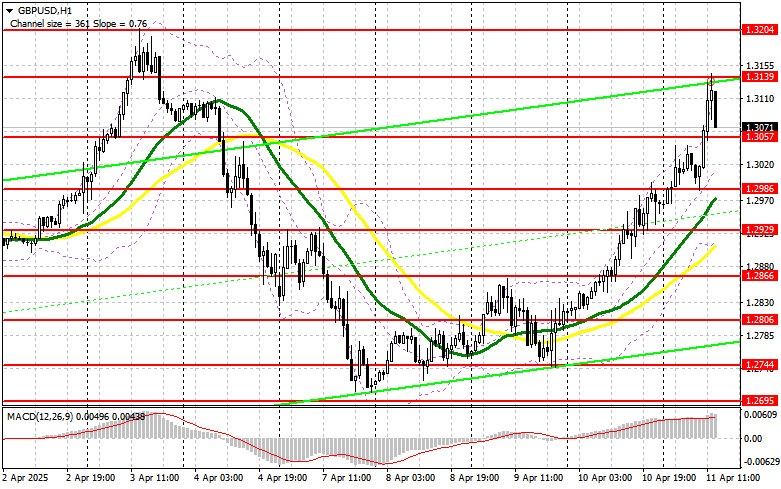

Moving Averages:

Trading is taking place above both the 30- and 50-day moving averages, indicating the pair is still in a corrective uptrend.

Note: The moving average periods and prices are analyzed on the H1 (hourly) chart, which may differ from classical daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2929 will act as support.

Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair declined rather significantly on Tuesday. While the pound's drop began somewhat sluggishly, in the evening, Donald Trump finally decided

Analysis of Tuesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed a relatively substantial decline on Tuesday. Euro quotes fell almost throughout the day, with the move intensifying

On Tuesday, the GBP/USD currency pair showed very low volatility and a general lack of interest in trading. While the euro traded with a noticeable decline, the British pound mostly

The EUR/USD currency pair traded lower on Tuesday. Once again, volatility was far from low, which might suggest the presence of significant events or news during the day. However, there

In my morning forecast, I highlighted the 1.1485 level as a key decision point for market entry. Let's look at the 5-minute chart and examine what happened. The pair dipped

Analysis of Monday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade with substantial gains throughout Monday. On the first trading day of the week, there were

Analysis of Monday's Trades 1H Chart of EUR/USD The EUR/USD currency pair started Monday with a sharp rally. Overnight, the euro appreciated by 100–120 pips, and the pair traded more

The GBP/USD currency pair continued its upward movement on Monday as it did last week. The only difference was the strength of the movement. On Monday, volatility was very high—without

The EUR/USD currency pair shot up again on Monday—straight to the moon. This time, the euro gained a "modest" 150 pips in a single day, even though no macroeconomic reports

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.