Voir aussi

30.06.2022 10:18 AM

30.06.2022 10:18 AMToday, the market will close the auction for the first summer month. We will summarize the results of this event tomorrow. However, it is already possible to assume with a very high degree of probability that the bulls in the single European currency will not be able to win back all the losses incurred at the June auction. If we touch on the external background and note the most important events, then they can certainly be considered a parade of speeches by heads at the forum of the world's leading Central banks. In particular, the President of the European Central Bank (ECB) Christine Lagarde expressed concern about fragmentation, which is a traditional threat to the structure of the euro area. According to Lagarde, the necessary instruments will be considered at the July meeting of the ECB to neutralize this threat. In general, let me remind you that expectations from the July meeting of the European Central Bank are very high, and first of all this is due to the beginning of a cycle of rate hikes to combat excessively high inflation.

But the chairman of the Federal Reserve System Jerome Powell decided to address the problem of deglobalization, designating it as one of the threats. Regarding some of the revised monetary policy parameters, the head of the Fed said that the basic foundation remains the same, which means that the Fed is not going to turn away from the path of tightening monetary policy and raising rates. Looking into today's economic calendar, we can note some events that can affect the course of trading on EUR/USD. Unemployment reports will be submitted from Germany and the eurozone as a whole. But the United States, as often happens, will offer the market a more extensive program, which will include initial applications for unemployment benefits, personal income, and expenses of Americans, as well as the basic price index of personal consumption expenditures. Yes, another speech by ECB Head Christine Lagarde is scheduled for 14:30 London time, but, to be honest, it is not necessary to expect anything new or important from him. Everything has been said for a long time, now the market will wait for real steps from the ECB.

Daily

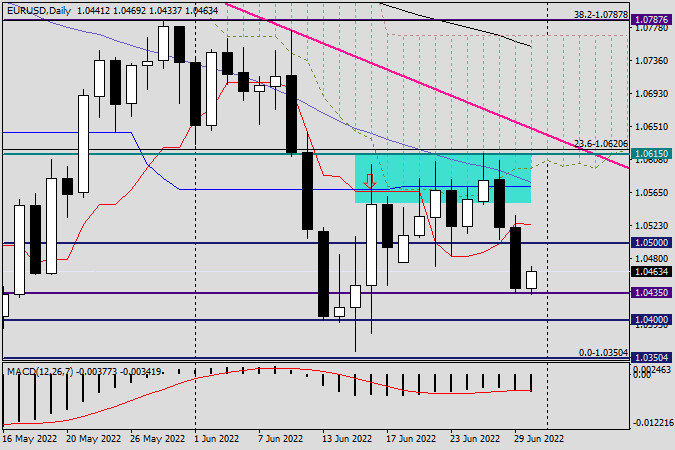

The euro/dollar growth that started several times stopped near the important technical level of 1.0600, which indicates a strong resistance of sellers concentrated in this area. So, after the highs shown on June 27 at 1.0615, the pair decided to turn around in the already familiar south direction. As can be seen on the EUR/USD daily chart, a strong and key resistance was provided by the Tenkan red line, which stopped the timid attempts of euro bulls to raise the exchange rate and brought it down. It is characteristic that only at 1.0435 did the pair find support and stopped its decline. Now, at the moment of the completion of the article, there are attempts at growth, which obviously cannot be called confident. Resistance in this timeframe runs at 1.0520, 1.0575, and 1.0615. At the same time, only a true breakdown of the last mark will open the way for EUR/USD bulls to higher prices. At the moment, I recommend looking closely at the sales of the EUR/USD pair after reaching the listed resistances. With such positioning, it would be quite useful to find confirmation for opening short positions in the form of candle signals that will appear at this or smaller time intervals.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analytics Populaires Ouvrir un compte de trading Important : Les débutants en trading forex doivent

Tôt dans la session américaine, la paire EUR/USD se négocie autour de 1,1358 au sein du canal baissier formé le 18 avril. La paire est sous pression baissière. Nous pensons

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analytique Populaire Ouvrir un compte de trading Important : Les débutants dans le trading forex

Sur le graphique de 4 heures, l'instrument de la matière première argent est visible même si sa condition se renforce, ce qui est confirmé par le mouvement du prix

Bien que sur le graphique de 4 heures, l'indice Nasdaq 100 soit en phase latérale, la fourchette est assez large pour offrir une opportunité assez prometteuse. Actuellement, l'indicateur Stochastic Oscillator

Avec l'apparition d'une divergence entre le mouvement des prix de la paire de devises croisées AUD/JPY et l'indicateur Stochastic Oscillator, ainsi que le mouvement des prix de l'AUD/JPY

Si nous examinons le graphique de 4 heures, l'instrument de la commodité Or semble toujours évoluer dans un biais haussier, mais l'apparition d'une divergence entre le mouvement du prix

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analyses Populaires Ouvrir un compte de trading Important : Les débutants en trading forex doivent

InstaForex en chiffres

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.