Voir aussi

11.04.2023 09:37 AM

11.04.2023 09:37 AMDespite the ongoing holidays in Europe and the complete absence of any macro data, just before the opening of the US trading session, that is, in the pre-market, the dollar noticeably strengthened. Moreover, this happened quite rapidly. Afterwards it gradually returned to its previous values. It is unlikely that this was a market reaction to the United States Department of Labor report. Most likely, it was just a random surge after the long weekend. The market was virtually inactive for almost four days, taking into account the holidays, of course. After all, both Europe and North America were on holiday on Friday. The subsequent return of quotes to their original positions indicates that this is a random jump of a purely speculative nature.

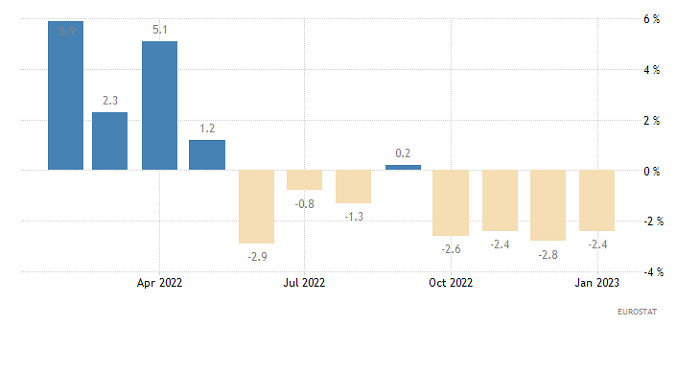

Today is a full-fledged trading day. And macro data is set to be published, which will undoubtedly influence investors' sentiment. The eurozone retail sales report will be released, with the decline rate expected to accelerate from -2.3% to -3.1%. Consumer activity, and retail sales being its best indicator, directly affects economic dynamics, and its decline indicates a downturn in the economy. This is especially true when it comes to accelerating this very decline. In other words, there seems to be no reason for the single currency to rise. Rather, on the contrary, there are prerequisites for its decline.

Retail sales (Europe):

EURUSD prolonged the pullback. As a result, the overall scale of the euro's weakening from the local high reached about 1.3%, which is approximately 140 points. If we compare this movement with the scale of the upward cycle from the middle of March, we can notice that the bullish sentiment persists since the overall market momentum has not been disrupted in any way.

On the four-hour chart, the RSI technical indicator is hovering in the lower area of 30/50, which points to the pullback stage. On the daily chart, the RSI is hovering in the upper area, which corresponds to the medium-term cycle.

On the four-hour chart, the Alligator's MAs are headed downwards, this correlates with the pullback stage. On the daily chart, the Alligator's MAs are headed upwards, which corresponds to the price's movement.

Outlook

The speculative decline that took place during the past day has been almost entirely played out. An increase in the volume of long positions emerged around the 1.0830 level, meaning the quote nearly reached the 1.0800 support level. For a technical signal indicating the end of the pullback stage, the quote needs to return above the 1.0950 level. In this case, there is a high probability of breaking the psychological level of 1.1000, which, in turn, will prolong the uptrend in the medium-term.

The bearish scenario considers the subsequent construction of a pullback, where, in case the price returns below the 1.0850 mark, the quote is likely to reach the 1.0800 level.

In terms of the complex indicator analysis, we see that in the short-term, technical indicators are pointing to an uptrend due to the rate of the euro's recovery relative to the recent decline. Meanwhile, in the intraday period, the indicators are focused on the downward cycle, which happened during the pullback period. And in the mid-term, the indicators are reflecting an upward cycle.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Graphiques Forex

Version Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.