Voir aussi

23.01.2024 10:25 AM

23.01.2024 10:25 AMThe economic calendar commonly lacks high-impact economic data on Monday. Yesterday was no exception. The US, the UK, and the EU did not release any economic reports.

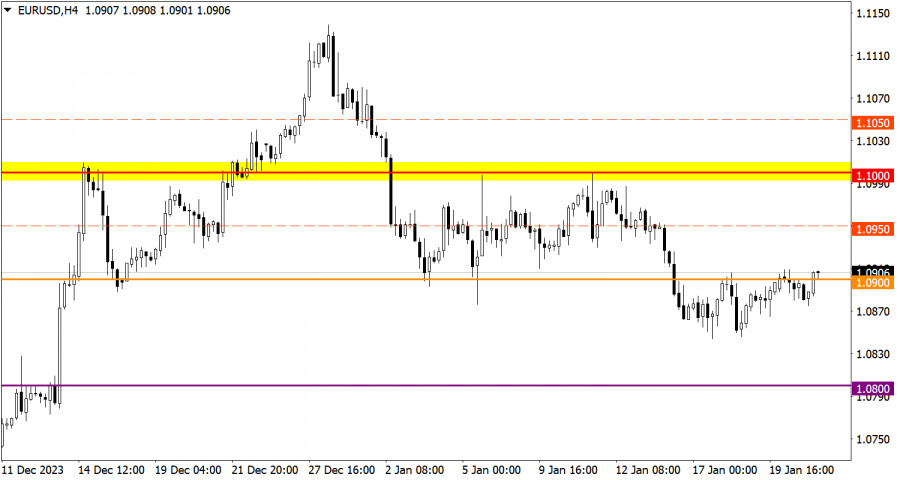

The EUR/USD pair has been moving around the 1.0900 level for the third day in a row with low trading activity. The level of 1.0850 serves as a variable support on the path of sellers. At this level, there was a reduction in short positions on EUR/USD.

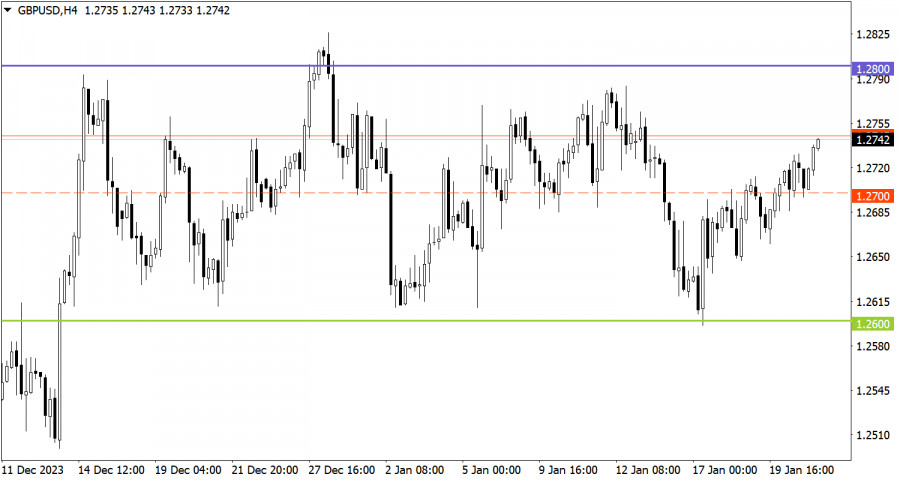

The GBP/USD currency pair is trading within the sideways channel of 1.2600/1.2800, consistently approaching the defined borders. At the moment, we see the consolidation above the average level of 1.2700, which indicates an increase in long positions on the range-bound market.

Today the economic calendar is equally empty as on Monday. No macroeconomic data will be released in the US, the UK, and the EU.

Consolidation of the price above 1.0900 during the day may lead to an increase in the volume of long positions in the direction towards 1.1000. As for the bearish scenario, it will come into play if the price drops below 1.0850.

In this situation, we may go ahead trading within the borders of the sideways channel. We reckon the instrument could approach the upper border at 1.2800.

However, we should not forget that the range-bound market is a temporary pattern, which leads to the accumulation of trading forces and abundant attention from speculators. As a result, the instrument will gain a certain momentum and break any of the borders. When the flat market is over, the price will indicate a further direction in the market. For this reason, you should always consider the breakout strategy.

The candlestick chart type consists of graphic rectangles in white and black with lines at the top and bottom. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, maximum and minimum price.

Horizontal levels are price coordinates relative to which a price may stop or revered its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price developed. This color highlighting indicates horizontal lines that may put pressure on the price in the future.

Up/down arrows are guidelines for possible price direction in the future.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

La paire de devises GBP/USD a poursuivi un mouvement latéral ce vendredi, se maintenant près des plus hauts de trois ans. Le fait que la livre sterling refuse même

Dans ma prévision matinale, je me suis concentré sur le niveau de 1,3310 et j'ai prévu de prendre des décisions de trading à partir de là. Regardons le graphique

Dans ma prévision matinale, je me suis concentré sur le niveau de 1.1391 et j'ai prévu de prendre des décisions d'entrée autour de celui-ci. Jetons un œil au graphique

La paire GBP/USD a continué à progresser jeudi, malgré l'absence de raisons objectives justifiant un tel mouvement. Il n'y a eu aucun événement significatif ni nouvelle au Royaume-Uni, Donald Trump

Jeudi, la paire de devises EUR/USD a légèrement évolué à la hausse, bien qu'il aurait été plus logique d'observer une baisse dans la seconde moitié de la journée. Aucun événement

Jeudi, la paire de devises GBP/USD a continué à évoluer dans un "style euro." Les mouvements intrajournaliers ont été relativement faibles, et le tableau technique suggère que la tendance pourrait

La paire de devises EUR/USD a évolué de manière beaucoup plus calme jeudi que pendant la première moitié de la semaine, et le marché était également relativement plus technique. Depuis

Dans mes prévisions du matin, j'ai mis en avant le niveau de 1.3293 et prévu de l'utiliser comme référence pour entrer sur le marché. Examinons le graphique de 5 minutes

Dans ma prévision matinale, je me suis concentré sur le niveau de 1.1358 et j'avais prévu de prendre des décisions de trading basées sur celui-ci. Jetons un coup d'œil

Notifications

SMS/E-mail

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.