Lihat juga

31.03.2025 07:58 PM

31.03.2025 07:58 PMTrade Breakdown and Tips for Trading the British Pound

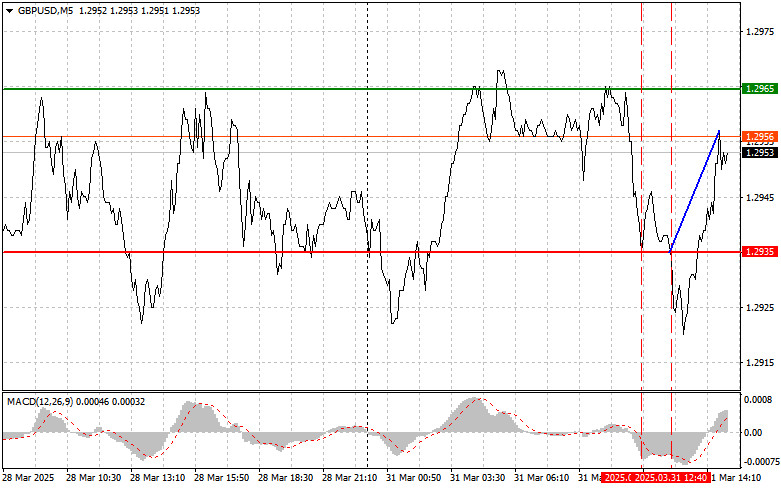

The price test at 1.2935 occurred when the MACD had already moved significantly below the zero mark, which limited the pair's downward potential. A short time later, there was another test of 1.2935, and this time the MACD was in the oversold zone, which enabled Scenario #2 for a buy trade. Although not immediately, the pound eventually rose.

Weak lending data from the UK put renewed pressure on the pound and limited its upward potential. Investors had likely expected more robust figures, especially considering the Bank of England's recent statements emphasizing the need for a tighter monetary policy. However, the statistics showed otherwise, triggering a wave of pound selling.

In the second half of the day, aside from the US Chicago PMI, there are no other major economic releases, so the pound does have a chance to rise. If the figure beats expectations, it could spark further pound growth. Otherwise, a downward correction may be in store. It's also important not to ignore global economic factors that could influence the currency's movement—particularly Donald Trump's statements regarding reciprocal tariffs, which are set to take effect in a number of countries in just two days.

As for the intraday strategy, I'll focus primarily on executing Scenarios #1 and #2.

Buy Signal

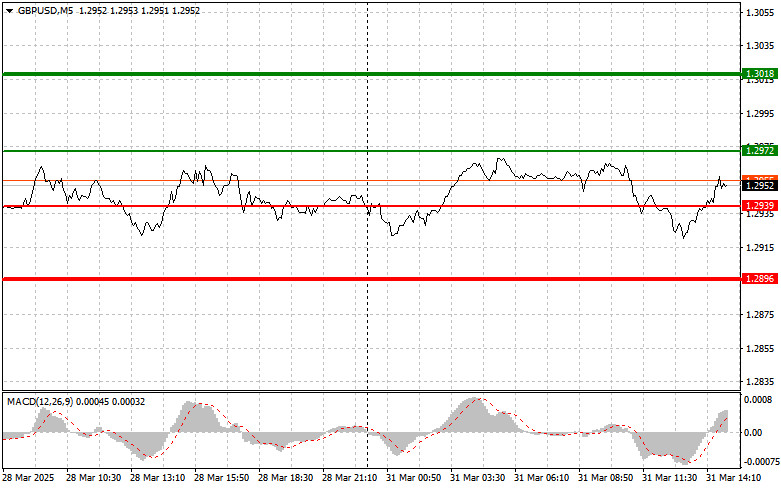

Scenario #1: I plan to buy the pound today upon reaching the entry point near 1.2972 (green line on the chart), targeting a rise to 1.3018 (thicker green line). Around 1.3018, I'll exit long positions and switch to short trades (expecting a 30–35 point move in the opposite direction). A rise in the pound today will depend on weak US data.Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of the 1.2939 level, when the MACD is in the oversold zone. This will limit the pair's downward potential and could lead to an upward reversal. A move toward the opposite levels of 1.2972 and 1.3018 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after breaking below 1.2939 (red line on the chart), which should lead to a quick drop in the pair. The key target for sellers will be 1.2896, where I'll exit shorts and open immediate long positions (expecting a 20–25 point rebound from that level). Sellers are likely to step in if US data proves strong.Important: Before selling, make sure the MACD is below the zero mark and just starting to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.2972, while the MACD is in the overbought zone. This would limit the pair's upward potential and could lead to a downward reversal. A decline toward the opposite levels of 1.2939 and 1.2896 can be expected.

Chart Key:

Important: Beginner Forex traders should be extremely cautious when entering the market. It's best to stay out of trades before major fundamental reports to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you're not using money management and are trading with large volumes.

And remember, successful trading requires a clear trading plan, like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for any intraday trader.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji level harga 143.21 bertepatan dengan indikator MACD yang baru mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual dolar dan menghasilkan penurunan menuju level target

Pengujian level harga 1,3352 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli pound. Penjualan saat rebound

Uji level harga 1.1371 pada paruh kedua hari itu bertepatan dengan indikator MACD yang baru mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli euro

Pound Mencatat Pertumbuhan Kuat, Memperbarui Tertinggi Bulanan, Sementara Euro Tidak Menunjukkan Kepercayaan yang Sama Kuat Kemarin, para trader mengalihkan fokus mereka ke pernyataan baru mengenai negosiasi trader dan situasi geopolitik

Analisis Trading dan Tips untuk Trading Pound Inggris Uji level 1.3309 terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang valid untuk menjual

Analisis Trading dan Tips untuk Trading Euro Uji level harga 1.1341 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena

Uji harga di 143.75 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Pengujian harga di 1,3317 terjadi ketika indikator MACD bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli pound. Pound menunjukkan sedikit

Uji pertama pada level harga 1.1340 di paruh kedua hari itu bertepatan dengan saat indikator MACD sudah bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.