Lihat juga

01.04.2025 07:52 PM

01.04.2025 07:52 PMTrade Review and Euro Trading Recommendations

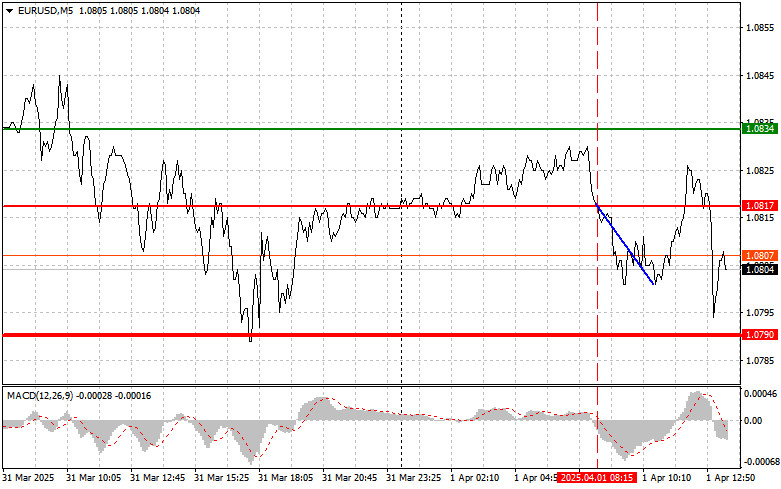

The test of the 1.0817 price level coincided with the MACD indicator just beginning to move downward from the zero line, which confirmed a valid entry point for selling the euro. However, after a 17-point drop, the pressure on the pair subsided.

The anticipated weak PMI data from the Eurozone manufacturing sector failed to exert the expected pressure on the euro. Under current circumstances, this is unlikely to significantly affect the European Central Bank's actions, so traders are in wait-and-see mode ahead of tomorrow's information from Trump regarding tariffs. It's clear that in the short term, the euro will likely remain under pressure due to weak economic data and uncertainty around the ECB's future policy.

Today, the U.S. ISM manufacturing index and JOLTS job openings data from the Bureau of Labor Statistics are due. However, the most interesting event will be the speech by FOMC member Thomas Barkin. Traders are paying close attention to each Federal Reserve official's comments and hints. Given the uncertainty around future interest rate policy, any signals indicating a hawkish stance are seen as cues to support the dollar.

Thomas Barkin, known for favoring tighter monetary policy, could influence market expectations. If he confirms the Fed's willingness to keep rates elevated for longer than expected, it could spark a rise in Treasury yields and, as a result, enhance the dollar's attractiveness to investors. Conversely, if Barkin's tone is softer than expected, the dollar may come under pressure.

As for the intraday strategy, I'll rely more on the execution of scenarios #1 and #2.

Buy Signal

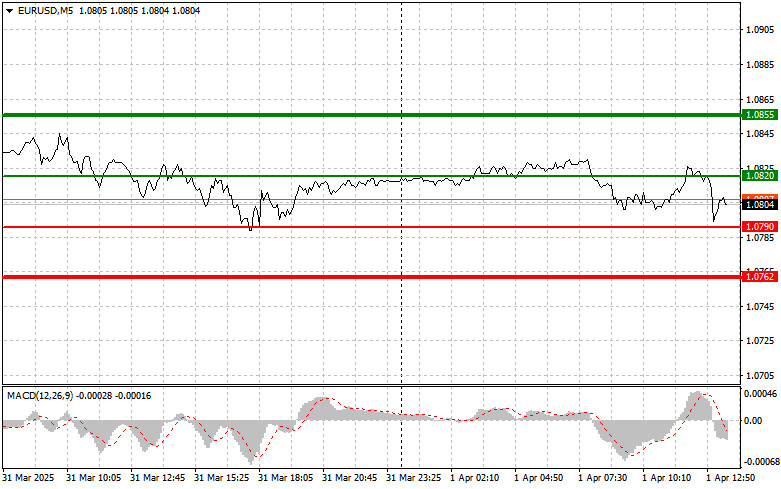

Scenario #1: I plan to buy the euro today upon reaching the 1.0820 entry point (green line on the chart), aiming for growth toward 1.0855. At 1.0855, I plan to exit long positions and sell the euro in the opposite direction, expecting a 30–35 point pullback. Buying the euro today is only justified if U.S. data disappoints and Fed officials strike a dovish tone. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today after two consecutive tests of the 1.0790 level, when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward 1.0820 and 1.0855 is expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.0790 (red line on the chart). The target will be 1.0762, where I intend to exit short positions and buy in the opposite direction, expecting a 20–25 point bounce. Pressure on the pair could return if Fed officials adopt a hawkish tone. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the euro today after two consecutive tests of the 1.0820 level, when the MACD is in overbought territory. This will limit the pair's upward potential and trigger a downward reversal. A decline to the 1.0790 and 1.0762 levels can be expected.

Chart Reference Guide:

Important: Beginner Forex traders must be extremely cautious when making market entry decisions. It's best to stay out of the market ahead of major fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you're not applying proper money management and trading with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are typically a losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji harga di 143.28 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar. Akibatnya, pasangan ini naik sebesar

Uji harga di 1,3111 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini pada akhir pekan. Oleh karena itu, saya tidak membeli

Pengujian harga di level 1,1375 terjadi ketika indikator MACD baru saja mulai bergerak naik dari titik nol, mengonfirmasi validitas titik masuk long yang mendukung tren bullish saat ini. Akibatnya, pasangan

Euro dan pound mempertahankan posisinya terhadap dolar AS, pulih setelah berita bahwa harga produsen AS pada bulan Maret turun tajam—sama seperti data inflasi inti hari sebelumnya. Data Indeks Harga Produsen

Analisis dan Saran untuk Trading Yen Jepang Uji level harga 143,49 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang tepat

Analisis Trading dan Kiat-kiat untuk Trading Pound Inggris Pengujian level harga 1,3024 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli

Analisis dan Tips Trading untuk Euro Uji level harga 1.1296 terjadi ketika indikator MACD baru mulai bergerak naik dari tanda nol, yang mengonfirmasi titik masuk yang tepat untuk membeli euro

Pengujian harga pada 145.,20 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Namun, hal ini tidak mencegah penjualan dolar AS, karena pengujian

Uji harga di 1,2946 terjadi ketika indikator MACD bergerak jauh di atas garis nol. Namun, uji ini bertepatan dengan rilis data AS yang membenarkan pembelian GBP berdasarkan ekspektasi pelemahan dolar

Pengujian harga di 1,1105 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol. Namun, setelah rilis data utama AS, ini tidak menghalangi masuknya pembelian euro dengan harapan terbentuknya

Ferrari F8 TRIBUTO

dari InstaTrade

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.