Lihat juga

02.04.2025 12:17 PM

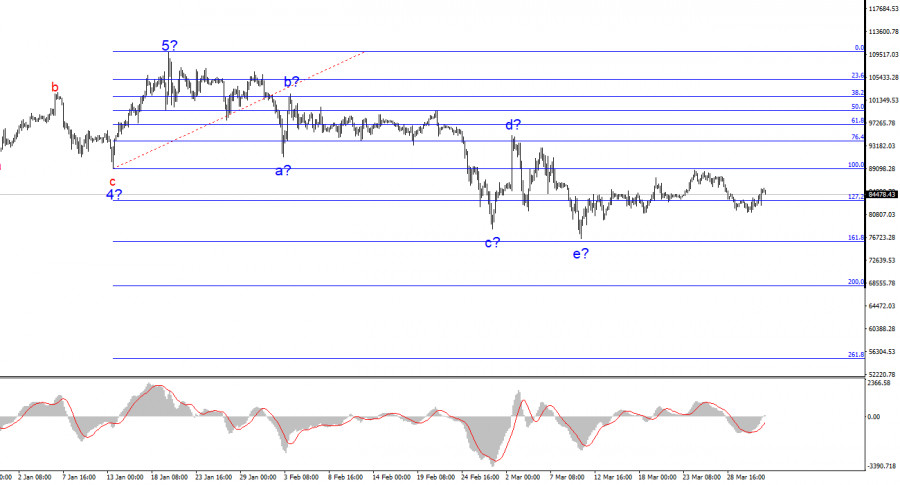

02.04.2025 12:17 PMThe wave pattern on the 4-hour BTC/USD chart is clear. After completing a bullish trend composed of five full waves, a downward corrective phase began, which is still in progress. Based on this, I did not—and still do not—expect Bitcoin to rise above $110,000–$115,000 in the coming months.

The news backdrop had been supporting Bitcoin thanks to a steady flow of headlines about new investments from institutional traders, various governments, and pension funds. However, Trump and his policies have caused investors to exit the market—no trend can rise indefinitely. The wave that began on January 20 does not resemble an impulsive one. Thus, we are dealing with a complex corrective structure that could take months to form. Internally, this first wave is quite intricate, but a five-wave a-b-c-d-e structure within it can be distinguished. If the current wave count is correct, we are now seeing the formation of an upward corrective wave, which in classical theory consists of three waves. Waves a and b appear to be complete.

The BTC/USD rate has stabilized, and the current wave count suggests further upward movement. But how strong might this growth be? Many in the market panic if Bitcoin drops by $10,000–$15,000. However, given Bitcoin's extreme volatility, such a move can occur in just a few days. The price fell $33,000 from its all-time high—and even that correction doesn't seem excessive enough to expect a fresh bullish trend.

Therefore, I anticipate a corrective wave or series of waves, after which the broader corrective structure will continue to develop.

At the moment, Bitcoin is consolidating, and the market is waiting. Some might view a drop to $80,000 as sufficient—but let me remind you of the period from November 2021 to November 2022, when Bitcoin fell from $69,000 to $16,000. Back then, economists and crypto analysts also predicted continued growth and a target of $100,000, but Bitcoin lost nearly 80% of its value. Why couldn't a similar scenario unfold now?

That previous decline lasted a full year. This one has been unfolding for only 2.5 months. Trump may announce new global tariffs as soon as today, and under Donald Trump, Bitcoin tends to fall. It's quite symbolic that the decline began on January 20—Trump's inauguration day.

Given the above and the current wave structure, I believe the downtrend will continue.

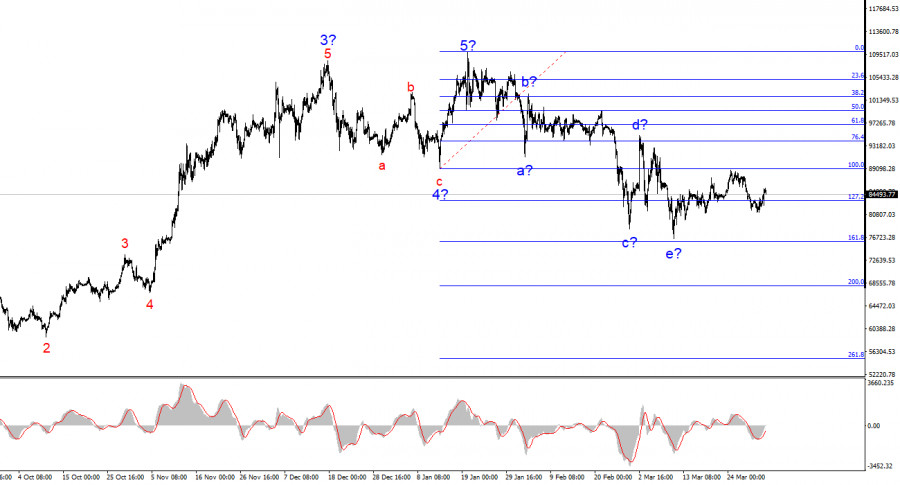

Based on the BTC/USD analysis, I conclude that the current growth phase is over. All signs point toward a complex, multi-month correction. That's why I have previously advised against buying crypto—and now, even more so. A drop below the low of wave 4 indicates a transition into a downward trend phase, most likely of a corrective nature.

In this context, the best strategy is to look for selling opportunities. A short-term upward corrective wave may occur soon, during which new short positions can be considered with targets near $68,000 and possibly as low as $55,000.

Higher Timeframe Outlook

On the higher wave scale, a five-wave bullish structure is visible. We are now witnessing the beginning of a corrective or bearish wave structure, potentially marking a new downtrend.

Core Principles of My Analysis:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Upaya yang tidak berhasil kemarin untuk tetap di atas $94.000 menunjukkan bahwa masih ada minat beli yang signifikan. Ethereum juga bertahan dengan cukup baik, meskipun koreksi kemarin selama sesi Eropa

Dengan kondisi indikator Stochastic Oscillator yang sudah berada diatas level Overbought (80) meski saat ini masih bergerak diatas WMA (30 Shift 2) dimana ini menandakan biasnya masih Bull, namun berdasarkan

Meski saat ini mata uang kripto Solana tengah bergerak dalam kondisi yang menguat dimana hal ini ditandai oleh pergerakan harganya yang bergerak diatas WMA (30 Shift 2) namun dengan kemunculan

Pola gelombang pada grafik 4 jam untuk BTC/USD menjadi agak lebih kompleks. Kami mengamati struktur korektif ke bawah yang menyelesaikan formasinya di sekitar angka $75,000. Setelah itu, pergerakan naik yang

Kemarin bitcoin mengalami rally yang kuat. Setelah menembus level $90.000, cryptocurrency terkemuka ini melonjak menuju $94.000, tempat kenaikan tersebut sementara terhenti. Ether juga mencatatkan kenaikan yang mengesankan. Setelah diperdagangkan

Bitcoin berhasil menembus di atas $90.000, sementara Ethereum naik lebih dari 10% hanya dalam satu hari, kembali ke $1.800. Yang menjadi katalis utama adalah pernyataan Donald Trump kemarin, yang menjelaskan

Bitcoin Kembali ke Zona $88.000, tetapi Ethereum Menghadapi Tantangan Penjualan kemarin selama sesi AS, kembali dipicu oleh penurunan indeks saham Amerika, yang diimbangi oleh pembeli Bitcoin, sementara Ethereum hanya sedikit

Bitcoin dan Ethereum, setelah menghabiskan seluruh akhir pekan bergerak menyamping dalam rentang tertentu, melonjak tajam selama sesi Asia hari ini. Kenaikan ini dipicu oleh rumor bahwa Ketua Federal Reserve

Setelah berhasil keluar dari pola Ascending Broadening Wedge di chart 4 jamnya mata uang kripto Litecoin yang diikuti oleh munculnya Divergence antara pergerakan harga Litecoin dengan indikator Stochastic Oscillator serta

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.