Lihat juga

03.04.2025 09:12 AM

03.04.2025 09:12 AMThe U.S. dollar had recently managed to stay above the key 104.00 mark on the ICE index, giving hope that a further decline might be avoided. But why did it tumble against other major currencies, especially considering that trade tariffs should also negatively impact the countries targeted by them?

Yes, this might seem odd at first glance, but there are clear reasons behind it, and they are likely to continue weighing on the dollar until the situation stabilizes.

As stated in a previous article, had Trump not introduced anything beyond the initially announced tariffs, the dollar might have received noticeable support yesterday. But that didn't happen. Instead, the U.S. president went beyond previously priced-in measures on the Forex market, equity indices, and Treasury yields. In addition to a base tariff of 10%—a more moderate figure than the previously floated 20%, which would have been seen as a positive—he announced additional tariffs for certain countries. According to Evercore ISI, the new weighted average tariff rate may rise to 29% after all new tariffs are implemented, the highest in over a century. This means that, collectively, the U.S. is imposing significantly higher trade barriers than initially expected.

Fears of a full-blown economic crisis and recession in the U.S. have driven investors into Treasuries, causing yields to plunge and adding downward pressure on the dollar. This decline in the Forex market is not due to strength in other currencies but rather the dollar's weakness. For example, the euro's rise contradicts the eurozone's economic issues. According to recent data, declining inflation raises the likelihood of further interest rate cuts—clearly a bearish factor for the euro versus the dollar, which might eventually find support on expectations of rate hikes if inflation picks up later this year.

In short, the dollar's drop is mostly an emotional reaction. This decline may be short-lived, ending once there's more clarity on the actual U.S. tariff rates and the retaliatory measures from trade partners. As mentioned above, fear of the unknown is pushing the dollar down. However, this decline could benefit the U.S., as it improves the competitiveness of American exports, which could strengthen the economy in the long run. In the meantime, speculators will likely take full advantage of the "tariff reality" before entering the market again at lower, more favorable price levels.

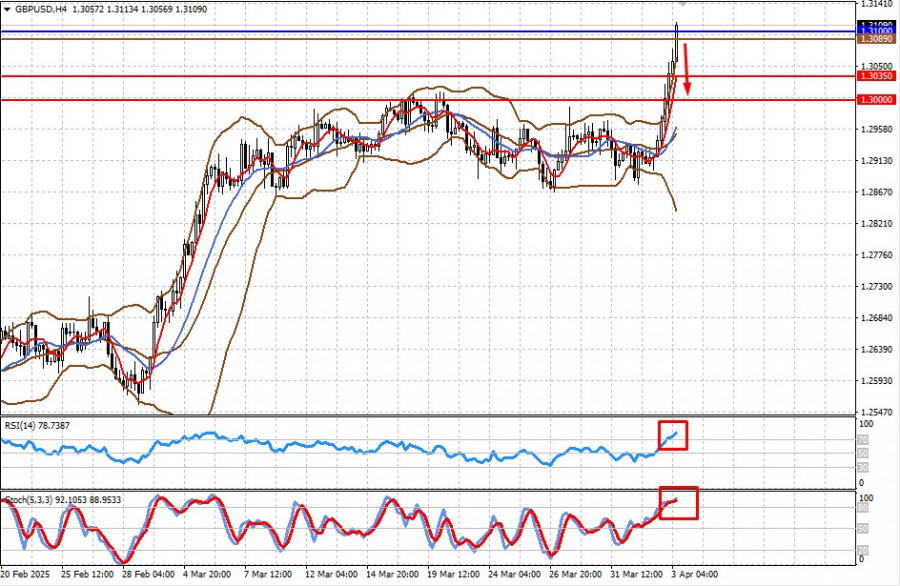

The pair is trading above the 1.3100 level. If it fails to hold above this mark, a pullback toward 1.3035 and then 1.3000 is likely.

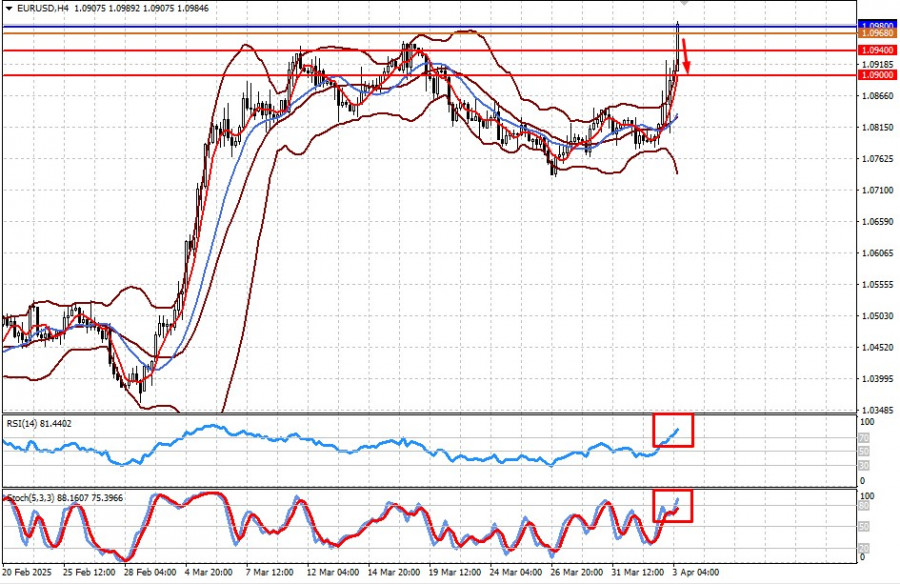

The pair is trading above the 1.0880 level. If it fails to stay above this level, a downward correction toward 1.0940 and then 1.0900 is possible.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Tidak ada acara makroekonomi yang dijadwalkan untuk hari Senin. Namun, latar belakang makroekonomi saat ini tidak terlalu menarik bagi para trader. Setidaknya, hal ini tidak menggerakkan pasangan mata uang. Oleh

Minggu lalu, EUR/USD mencatat rally paling kuat tahun ini, naik dari 1,0882 ke level tertinggi mingguan di 1,1474. Biasanya, lonjakan impulsif seperti ini diikuti oleh fase koreksi atau konsolidasi. Namun

Pada hari Jumat, pasangan mata uang GBP/USD juga diperdagangkan lebih tinggi. Namun, perlu dicatat bahwa mata uang Inggris—yang pernah dipuji karena ketahanannya yang luar biasa terhadap dolar dalam beberapa tahun

Pada hari Jumat, pasangan mata uang EUR/USD melanjutkan kenaikannya yang stabil. Pada titik ini, tidak ada lagi pertanyaan tentang apa yang terjadi di pasar mata uang—semuanya sangat jelas. Donald Trump

Akan ada beberapa peristiwa penting dalam minggu mendatang. Tentu saja, laporan seperti produksi industri, penjualan ritel, dan penjualan rumah baru perlu diperhatikan. Sekilas, laporan-laporan ini tampaknya tidak mampu mengubah sentimen

Euro menunjukkan kenaikan tajam terhadap dolar AS. Pasangan EUR/USD telah mencapai level tertinggi dalam tiga tahun dan tidak menunjukkan tanda-tanda melambat. Sementara itu, menurut survei para ekonom, pejabat di European

Pada hari Kamis, para investor menyadari bahwa saat ini tidak ada yang namanya stabilitas. Volatilitas pasar yang tinggi tetap ada dan akan terus mendominasi untuk beberapa waktu. Penyebab yang sedang

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.