Lihat juga

03.04.2025 10:49 AM

03.04.2025 10:49 AMDonald Trump confidently speaks about America's return to its Golden Age. From his viewpoint, it's time for America to prosper, rather than other countries. However, why does the US president consistently announce his decisions during stock market closures? Investors have figured out that the White House leader has no intention of throwing a lifeline to the S&P 500, but it's painful for him to watch the broad stock index sink. Futures for the S&P 500 plunged 4% after the announcement of a 10% tariff on all US imports. I fear this is just the beginning.

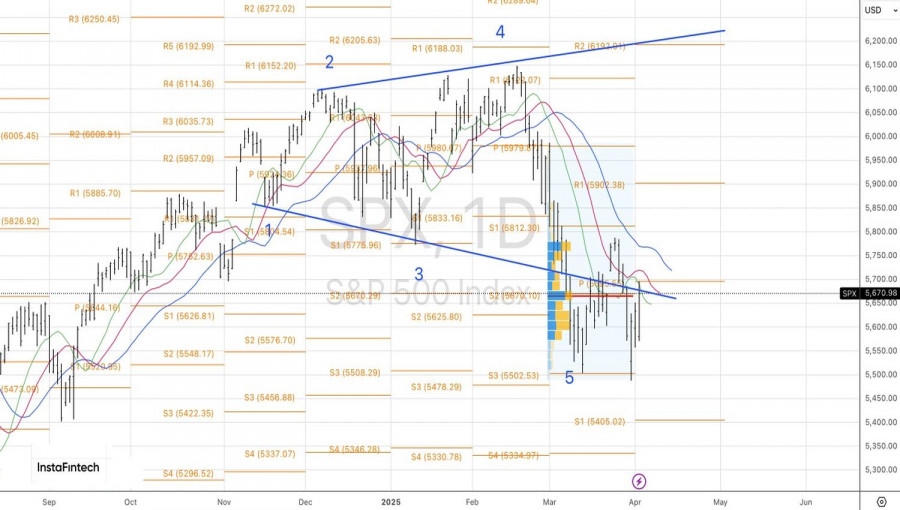

The three-day rally of the S&P 500 ahead of America's Liberation Day reflected hopes that Donald Trump's new tariffs would not be as scary as many had feared. Investors also hope that the US president will leave room for negotiations to lift them. Eventually, the uncertainty will clear up, allowing stock bulls to buy during dips.

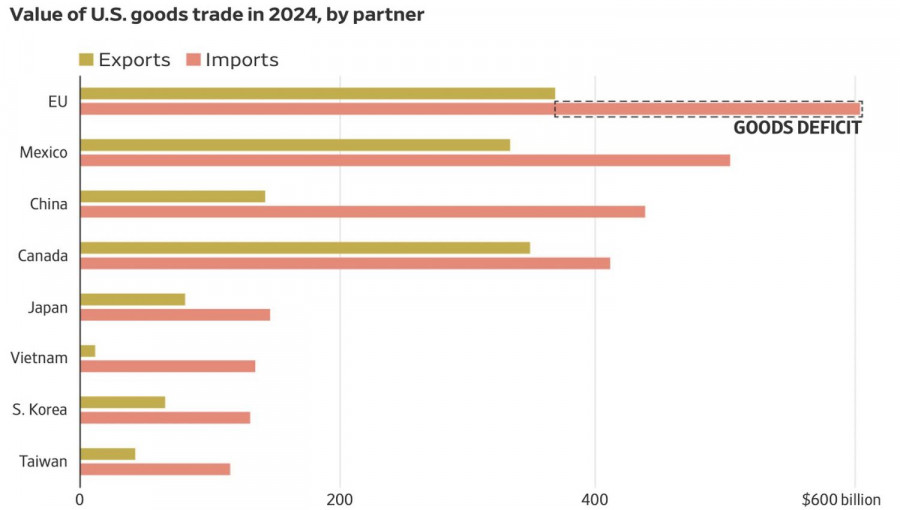

The dynamics and structure of US foreign trade

The reality turned out to be much tougher. The universal 10% tariff on all US imports is just the beginning compared to tariffs on individual countries from Scott Bessent's "dirty fifteen" list. The European Union faces a 20% tariff, Japan 24%, and China 34%. If you add the latter number to the previously announced 20% tariff for 2025 and then add the existing tariffs from this year, it almost totals 70%. And how could these countries not retaliate?

The European Union intends to do the same if negotiations with the US fail. Japan is currently demanding the removal of tariffs. But who knows how long it will take for Japan to join the ranks of the world's power players? Unlike 2018-2019, Donald Trump will not just be fighting with Beijing. Defeating the rest of the world is no easy task.

For the S&P 500, this means that market sentiment remains obscure about further prospects of the US economy. The VIX fear index spiked above the critical 20 level, stock indices worldwide are falling into the abyss, and the yield on 10-year Treasury bonds is heading toward 4%. It's as if they want a recession or are calling for help from the Federal Reserve.

US Treasury yield dynamics

Donald Trump's envisioned scenario of events is clearly stagflationary. It's no surprise that banks and companies, including Capital Economics, are raising inflation forecasts by an average of 2.5 percentage points while lowering GDP predictions. Such an environment is unfavorable for stocks. However, the resilience of the S&P 500 signals that the broad stock index is not fully accounting for the risks of a downturn in the US economy. If it does happen, the selloff will snowball.

Technically, the daily chart of the S&P 500 still suggests a chance of the Double Bottom reversal pattern materializing. However, if the broad stock index fails to hold above its fair value of 5,670 or return to it after an opening gap, it will provide grounds for selling toward 5,500 and 5,400. It makes sense to benefit from the increase after a gap to open short positions.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Para pejabat di Bank Sentral Eropa sedang bersiap untuk terus menurunkan suku bunga, dengan memperkirakan bahwa kebijakan tarif AS akan menyebabkan kerugian besar dan berkepanjangan pada ekonomi, bahkan jika pemerintahan

Minggu depan akan dipenuhi dengan rilis data ekonomi penting, yang dapat memiliki dampak signifikan pada dinamika pasar — tetapi apakah mereka mampu melakukannya? Di tengah kekacauan geopolitik yang dihasilkan oleh

Kalender ekonomi minggu depan penuh dengan rilis penting. Seperti biasa, awal bulan baru membawa laporan makroekonomi signifikan dari AS dan Zona Euro, yang biasanya memicu volatilitas kuat untuk pasangan EUR/USD

Tidak ada acara makroekonomi yang dijadwalkan pada hari Senin. Jika pasar hampir tidak bereaksi terhadap data makroekonomi minggu lalu, tidak ada yang diharapkan pada hari Senin. Tentu, Donald Trump mungkin

Dimulainya negosiasi yang sebenarnya dapat menyebabkan penurunan signifikan pada harga emas dalam waktu dekat. Dalam artikel sebelumnya, saya menyatakan bahwa harga emas yang sebelumnya melonjak dapat mengalami koreksi besar akibat

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.