Lihat juga

04.04.2025 07:55 PM

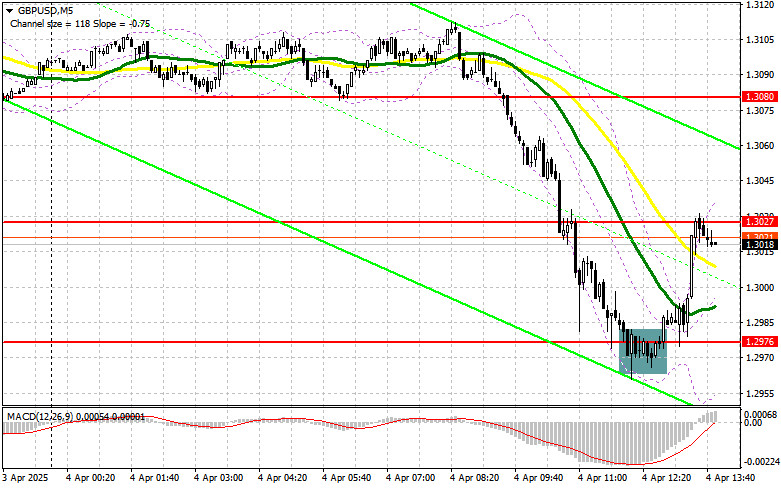

04.04.2025 07:55 PMIn my morning forecast, I highlighted the level of 1.2976 and planned to base market entry decisions around it. Let's look at the 5-minute chart to see what happened. A decline and the formation of a false breakout at that level provided an entry point for long positions, resulting in a rise of more than 60 points. The technical picture was revised for the second half of the day.

To Open Long Positions on GBP/USD:

The pound experienced a sharp correction following recent comments from Trump, who stated he would negotiate with countries individually. This complicates the negotiation process, which UK representatives had been counting on after the tariffs were introduced. U.S. nonfarm payrolls and the unemployment rate will play a major role this afternoon, and only strong data will lead to another sell-off in the pair. Powell's speech will also be in focus.

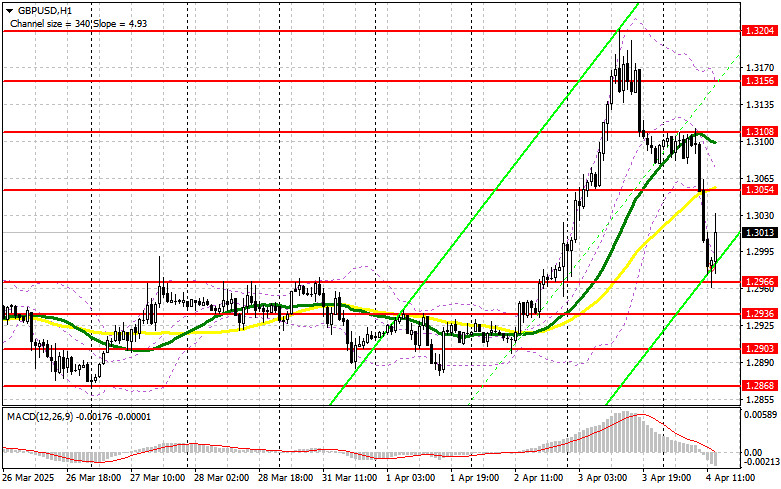

If the pair declines, I prefer to act around the 1.2966 support. A false breakout at that level, similar to the one discussed above, will provide a good entry point for long positions, aiming for a recovery toward 1.3054 resistance. A breakout and retest of this range from above will confirm a new entry point with the prospect of reaching 1.3108. The furthest target will be 1.3156, where I will take profits.

If GBP/USD continues to decline and buyers show no activity near 1.2966, things will go badly for the bulls, and pressure on the pound will increase significantly by the end of the week. In this case, only a false breakout near 1.2936 will be a suitable signal to go long. I also plan to buy on a rebound from 1.2903, targeting a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers have made their move and now rely on strong U.S. data to unwind all the gains the pair made after Trump's tariff announcements. If GBP/USD rises further, I won't rush into selling in such a market. Only a false breakout near 1.3054 will provide a sell entry point, targeting the new support at 1.2966, formed today. A breakout and retest of this range from below will trigger stop-losses, clearing the way to 1.2936, which would hurt the bulls. The furthest target will be 1.2903, where I will take profit. A test of this level may return the pair to a sideways range.

If demand for the pound returns this afternoon and bears do not act around 1.3054—where the moving averages are located—selling should be postponed until a test of the 1.3108 resistance. I will only open short positions there after a failed consolidation. If there's no downside reaction even there, I'll look for short entries on a rebound from 1.3156, but only for a 30–35 point correction.

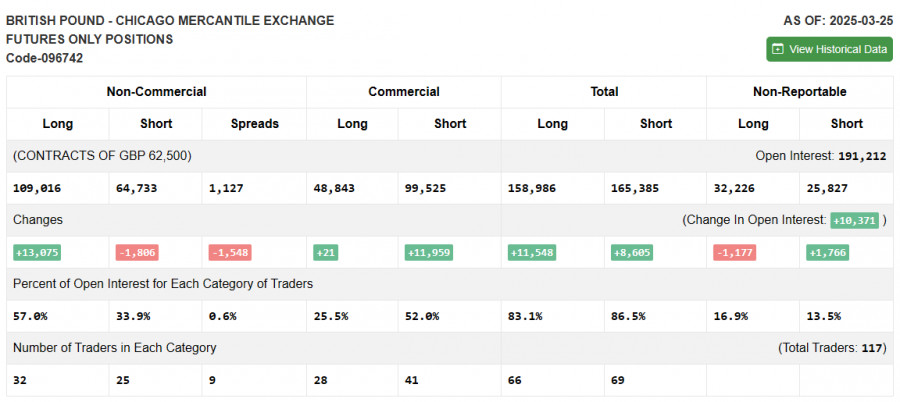

COT Report (Commitments of Traders) – March 25:

The report showed a rise in long positions and a reduction in short positions. Buying of the pound continues, as seen on the chart. While many risk assets have declined, the GBP/USD pair demonstrates stability.

Given the recent UK inflation data and statements from Bank of England officials, the central bank is likely to maintain its current policy stance at the April meeting, which could temporarily support the pound. However, the scale of the impact of U.S. tariffs will be critical. A greater threat of a slowdown in global growth will increase pressure on risk assets, including the pound. Long non-commercial positions increased by 13,075 to 109,016 and short non-commercial positions decreased by 1,806 to 64,733. The gap between long and short positions narrowed by 1,548.

Indicator Signals:

Moving Averages Trading is taking place below the 30- and 50-period moving averages, which signals a downtrend.

Note: The author uses H1 (hourly) chart settings, which may differ from standard daily moving averages on D1 charts.

Bollinger Bands In the event of a decline, the lower band near 1.2980 will serve as support.

Indicator Descriptions:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Senin, pasangan GBP/USD naik sebanyak 130 pips. Begitulah "Senin yang membosankan" tanpa laporan makroekonomi atau pidato penting. Pound sterling naik lebih dari satu sen tanpa alasan yang jelas

Pada hari Senin, pasangan mata uang EUR/USD menunjukkan pergerakan yang agak bervariasi, tidak peduli bagaimana Anda melihatnya. Di satu sisi, pasangan ini menunjukkan pergerakan naik yang kuat meskipun tidak

Pada hari Senin, pasangan mata uang GBP/USD kembali trading lebih tinggi meskipun tidak ada alasan fundamental. Namun, saat ini, semua trader seharusnya sudah terbiasa dengan perkembangan semacam ini. Sementara euro

Pada hari Senin, pasangan mata uang EUR/USD menunjukkan pergerakan naik yang cukup baik sepanjang hari, tetapi tetap berada dalam channel mendatar sempit di 1,1312–1,1414 (garis Kijun-sen). Ingat bahwa kini euro

Dalam prediksi pagi, saya fokus pada level 1,3342 dan merencanakan keputusan trading berdasarkan level tersebut. Mari kita simak grafik 5 menit dan perhatikan apa yang terjadi. Pasangan ini naik

Dalam perkiraan pagi saya, saya fokus pada level 1.1391 dan merencanakan untuk membuat keputusan perdagangan dari sana. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Meskipun

Pada hari Jumat, pasangan GBP/USD juga tidak menunjukkan pergerakan yang menarik. Seperti euro, pound Inggris tetap sangat dekat dengan rentang datar. Namun, mata uang Inggris masih mempertahankan sedikit kecenderungan naik

Pada hari Jumat, pasangan mata uang EUR/USD terus bergerak mendatar. Pasar terus mengabaikan semua data makroekonomi, dan minggu lalu sekali lagi mengonfirmasi fakta yang jelas ini. Bahkan tanpa mempertimbangkan laporan

Pada hari Jumat, pasangan mata uang GBP/USD melanjutkan trading mendatar, bertahan di dekat level tertinggi tiga tahun. Fakta bahwa pound Inggris menolak bahkan koreksi turun yang sedikit menunjukkan ketidakpercayaan pasar

Pada hari Jumat, pasangan mata uang EUR/USD terus bergerak mendatar. Pada paruh kedua minggu lalu, euro trading secara eksklusif antara level 1.1321 dan 1.1391, meskipun saluran mendatar secara keseluruhan dapat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.