Lihat juga

Japanese and Australian stocks gained, while China's CSI 300 index reached its highest level this year, reflecting renewed optimism about the potential for greater policy support to boost consumer spending.

U.S. Treasury bonds pared some of their previous session's gains, driving gold to a record high and supporting the dollar, which continued its rise on Friday, strengthening for a third consecutive day.

Avoiding a government shutdown removes some uncertainty from the markets, which are already anxious about U.S. economic growth, largely due to Donald Trump's trade war. Just two months into his presidency, Wall Street sentiment has shifted from optimism to nervousness. The $5 trillion sell-off in U.S. stocks occurred rapidly, prompting market participants to reduce risk exposure and pushing some investors to reallocate funds into Asian markets, particularly China.

Democratic and Republican lawmakers have engaged in a high-stakes game of chicken. Democrats are demanding that the spending package include certain restrictions on Elon Musk's DOGE spending program, while Republicans are refusing and challenging the opposition party, risking being blamed for a government shutdown. However, Senate Democratic Leader Chuck Schumer backed down from his threat to block the Republican spending bill, clearing the way to prevent a U.S. government shutdown.

Another source of pressure on stock indices is the escalation of the trade war. Trump has threatened to impose a 200% tariff on European wine, champagne, and other alcoholic beverages. Later on Thursday, Trump announced that he would not lift tariffs on steel and aluminum, which came into effect this week, and reaffirmed his plans for sweeping reciprocal tariffs set to take effect on April 2.

Meanwhile, oil prices rose as the U.S. tightened sanctions, and Bitcoin rebounded on Friday after declining on Thursday.

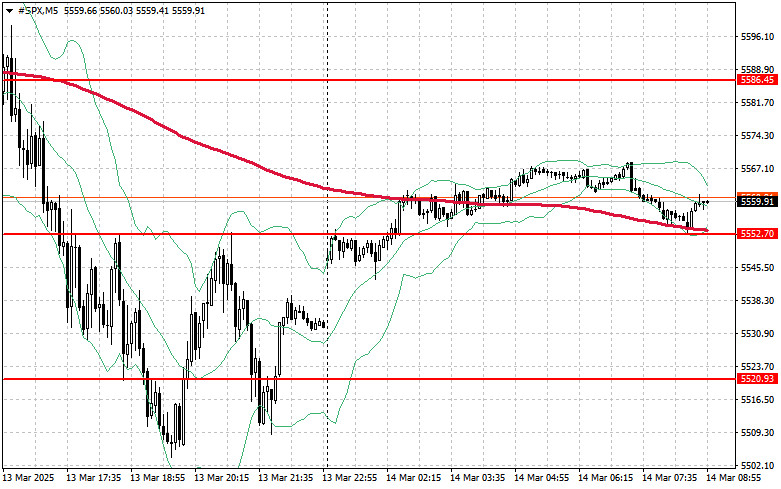

The decline in S&P 500 continues. The main challenge for buyers today will be breaking through the nearest resistance at $5,586. This would support further growth and potentially trigger a move toward the next level at $5,617.

Another key objective for bulls is to hold control above $5,645, which would further strengthen buyers' positions.

In case of a downward move due to reduced risk appetite, buyers must step in around $5,552. A break below this level could quickly push the index back to $5,520, opening the way to a further drop toward $5,483.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

E-mel/SMS

pemberitahuan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.