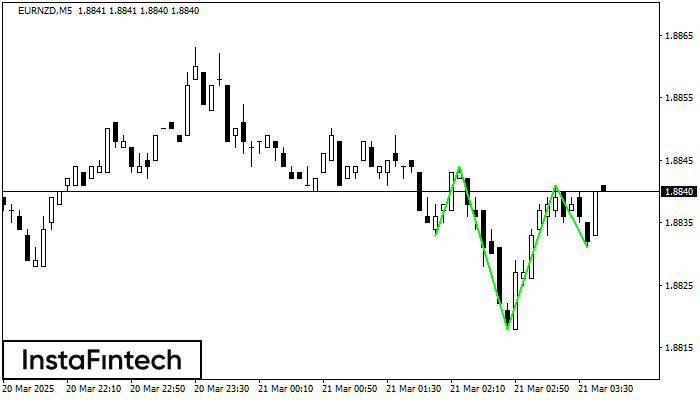

Inverse Head and Shoulder

was formed on 21.03 at 03:45:24 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURNZD formed the Inverse Head and Shoulder pattern. The Head’s top is set at 1.8841 while the median line of the Neck is found at 1.8818/1.8831. The formation of the Inverse Head and Shoulder pattern evidently signals a reversal of the downward trend. In other words, in case the scenario comes true, the price of EURNZD will go towards 1.8856

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength