یہ بھی دیکھیں

04.04.2025 09:09 AM

04.04.2025 09:09 AMThe global market crash triggered by the announcement of sweeping tariffs personally introduced by the U.S. President continues into Asian trading sessions. While the decline has slowed, there is still no sign of this trend weakening. Interestingly, gold prices have been behaving unusually and inconsistently in recent months. What's the reason?

In most countries, the atmosphere in markets and political circles can be best described as one of shock and awe. The onset of a widespread trade war between the U.S. and nearly the entire world has underscored America's true standing in the global hierarchy, which, despite internal divisions, remains pivotal. All global markets—stocks, currencies, cryptocurrencies, and commodities—reacted negatively to the so-called "day of liberation," resulting in a significant plunge. The U.S. dollar also fell sharply in response.

But in such a situation, something should have received support. So where did the money flow—even temporarily?

The primary beneficiary of the current situation has been government bonds, which saw a sharp increase in prices amid rising demand for safe-haven assets, resulting in falling yields. Investors rushed into the debt market, hoping to preserve some of their capital. U.S. Treasury yields plunged below 4%. German Bunds and British, French, and other developed nations' bonds followed the same trend. Demand for government bonds from economically developed countries surged, pushing yields down. Bond yields—particularly government ones—are calculated inversely: as prices rise, yields fall, and vice versa.

What about gold? Where does it stand, and why hasn't it emerged as a traditional safe-haven asset?

Indeed, gold is traded in U.S. dollars. The dollar has plummeted, so gold should have logically surged—but it hasn't. Traditionally, interest in gold as a safe haven grows in market chaos and geopolitical tension. But not now. Here's how I would explain it. First, gold prices are already in the stratosphere—true, though not the main reason, in my view.

The second reason is the sharp increase in gold reserves stored in COMEX warehouses across the U.S. in recent months, driven by fears that rising tariffs could disrupt supply. However, after the announcement that precious metals would not be subject to President Trump's "reciprocal" tariffs, demand for gold has been limited. That said, a significant drop in gold prices is unlikely. Most likely, the metal will consolidate near its recently reached highs. Fears of the inflationary impact of tariffs globally, combined with central bank purchases and strong demand for gold-backed ETFs, have helped contain the downside.

So, what can we expect from gold price dynamics?

I believe not much. A large-scale sell-off is unlikely. On April 5—tomorrow—we expect the "second act" of the drama, with Trump potentially announcing a new wave of tariffs. Since their scope is still unclear, today's negative trend in the markets may subside. We may even witness a short-term rebound in financial assets as positions are partially closed.

Today's U.S. jobs report will be released, but markets likely won't react enthusiastically, just as they haven't in recent weeks. The main focus remains on tariffs, the threat of global recession, and other issues triggered by the U.S. under President Donald Trump.

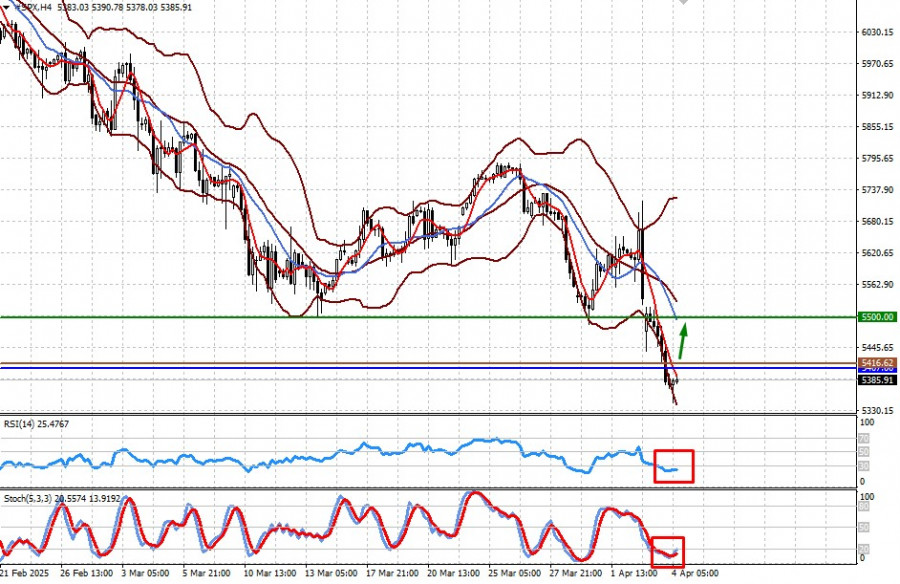

The CFD contract for the S&P 500 futures has paused its decline in anticipation of new tariff announcements expected from Donald Trump tomorrow. In this wave, the contract might experience an upward correction as some short positions are closed. If the price moves above 5407.00, it may trigger limited growth. A potential entry point could be the 5416.62 level.

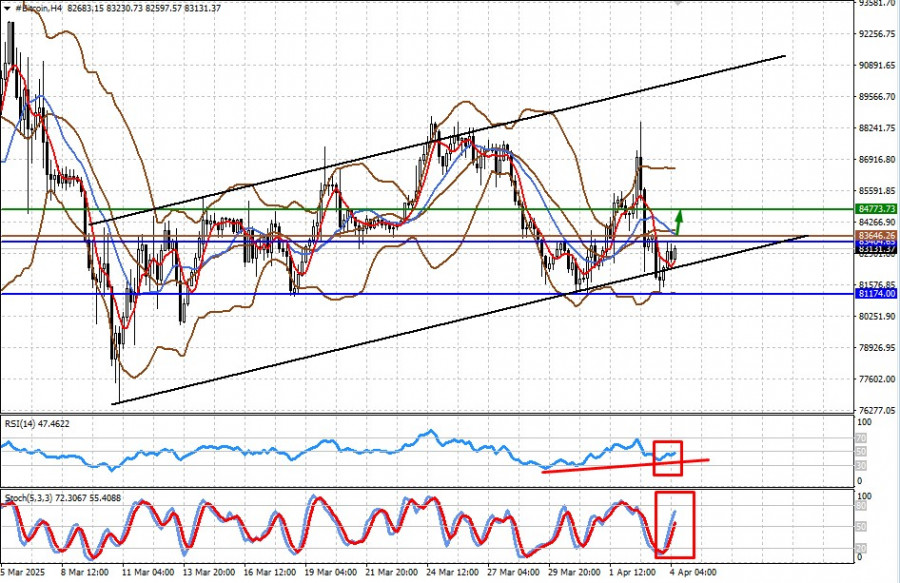

The cryptocurrency remains within a broad sideways range. A pause in market turmoil following the recent crash could lead to a local rise toward the 84,773.73 level. A potential entry point could be the 83,646.26 level.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

ای میل / ایس ایم ایس

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.