#KHC (The Kraft Heinz Company). Exchange rate and online charts.

Currency converter

18 Apr 2025 22:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Kraft Heinz Company (#KHC) is the US biggest manufacturer of food products which appeared after H.J. Heinz Company merged with Kraft Foods Inc. This amalgamation was carried out in 2015. The corporation is the fifth largest producer of food globally and the third largest company that manufactures food and drinks in the United States.

As a result of the merger which was initiated two years ago, Heinz shareholders took the controlling stake (51%) in the integrated company while shareholders of Kraft Foods Group obtained 49%. The company’s shares are listed on the NASDAQ.

In the fourth quarter of 2016 it was reported that shares in the Kraft Heinz Company depreciated significantly last year. The net sales volume, which is a rather important indicator for the company, decreased by 3.7%. Besides, the quarterly revenue of the Kraft Heinz Company plunged by $260 million from the previous year and came in at $6.86 billion. Later on, the Kraft Heinz Company managed to surmount the crisis and increased its revenue.

In late April 2017 the shares in the giant food manufacturer posted a downward dynamic. The beginning of May was quite volatile for the Kraft Heinz Company when the quarterly report was released. From the middle of May KHC shares have recovered, returning to $93 and even reaching higher levels.

The company’s revenue for the first quarter of 2017 slumped by 3.1% in annual terms from $6.57 billion to $6.364 billion. At the same time, the operating income rose by 2.5% to $1.551 billion while the net profit shrank by 0.3% to $893 million.

The revenue report of Kraft Heinz Company was disappointing as it showed a decrease in three out of four regions (a fall of 3.5% to $4.552 billion in the US, a decline of 1.2% to $443 million in Canada, and a slump of 6.8% to $543 million in Europe). According to CEO of Kraft Heinz Bernardo Hees, the company intends to pursue the current development strategy and take measures for cost saving, despite weak results and slow growth in 2017. The company’s management plans to introduce innovative solutions, renew the range of products and expand its business. Mr. Hees is sure that these measures will help the company to increase its revenue.

In early June of 2017 KHC shares were trading with moderate volatility, adding 0.84% for a week and 1.28% for a month. Experts say that under the current conditions the price is likely to reverse downwards towards the key support at $90.50. Once this level is reached, Kraft Heinz shares are better to be bought, experts advise. At the same time, the take profit level is recommended at $96 while the stop loss should be set at $88.

See Also

- Type of analysis

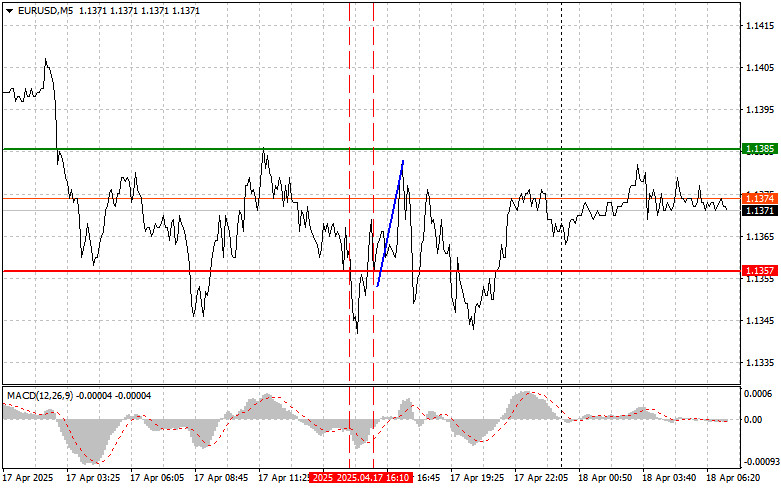

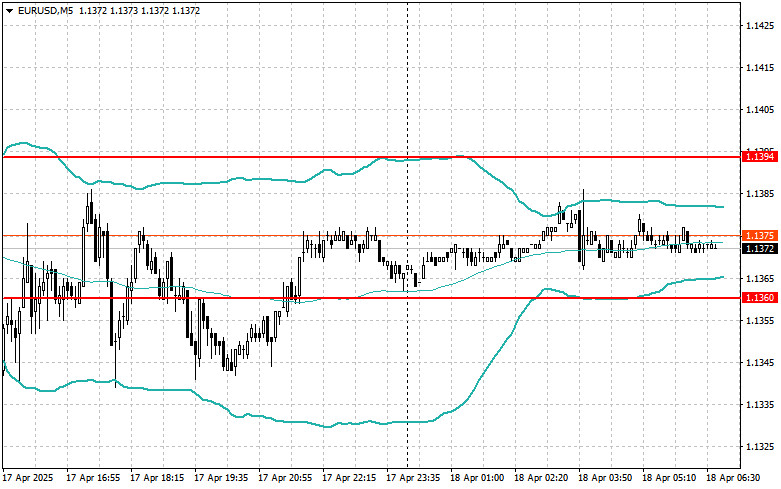

EUR/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:30 2025-04-18 UTC+2

1168

Donald Trump targets the Federal Reserve again, blaming Jerome Powell and threatening dismissal: a real threat or political pressure?Author: �lena Ivannitskaya

08:43 2025-04-18 UTC+2

1153

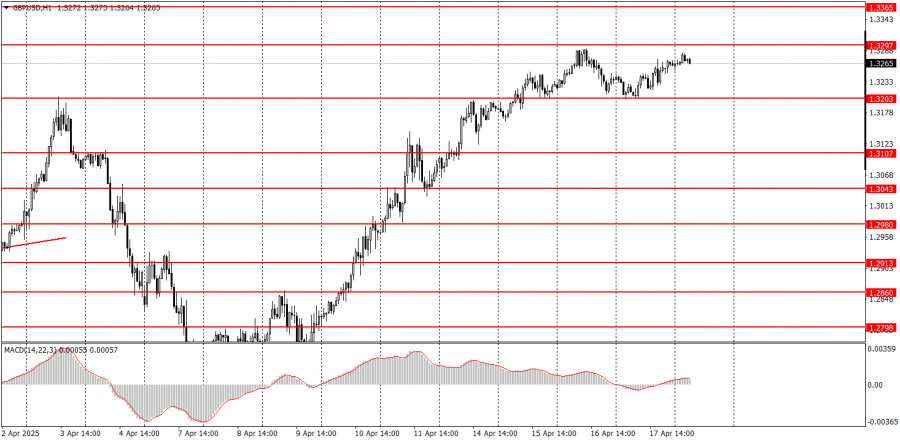

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward biasAuthor: Paolo Greco

03:48 2025-04-18 UTC+2

1108

- Type of analysis

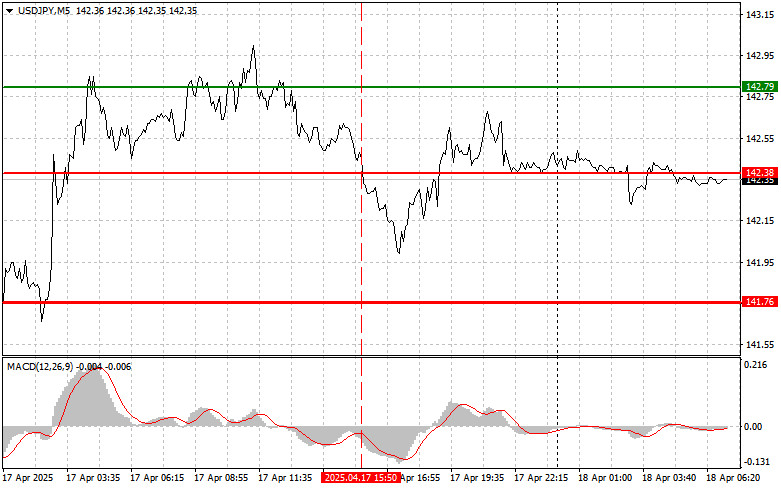

USD/JPY: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:33 2025-04-18 UTC+2

943

Trading planHow to Trade the GBP/USD Pair on April 18? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair continued to trade higher throughout ThursdayAuthor: Paolo Greco

06:51 2025-04-18 UTC+2

883

Technical analysis of EUR/USD, GBP/USD, Gold and BitcoinAuthor: Sebastian Seliga

10:18 2025-04-18 UTC+2

868

- Type of analysis

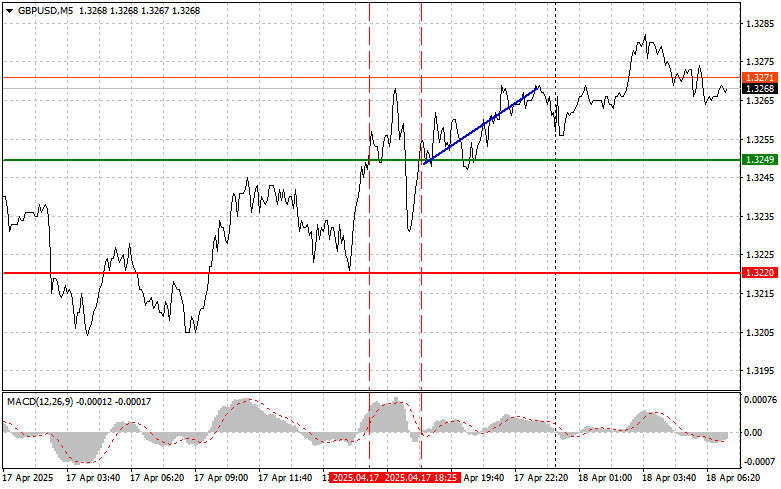

GBP/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-18 UTC+2

853

Donald Trump ratcheted up his criticism against Federal Reserve Chairman Jerome Powell, once again calling for an immediate interest rate cut. This renewed political pressure adds to the tensions surrounding the FedAuthor: Ekaterina Kiseleva

12:09 2025-04-18 UTC+2

853

Intraday Strategies for Beginner Traders on April 18Author: Miroslaw Bawulski

06:52 2025-04-18 UTC+2

838

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:30 2025-04-18 UTC+2

1168

- Donald Trump targets the Federal Reserve again, blaming Jerome Powell and threatening dismissal: a real threat or political pressure?

Author: �lena Ivannitskaya

08:43 2025-04-18 UTC+2

1153

- The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias

Author: Paolo Greco

03:48 2025-04-18 UTC+2

1108

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:33 2025-04-18 UTC+2

943

- Trading plan

How to Trade the GBP/USD Pair on April 18? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair continued to trade higher throughout ThursdayAuthor: Paolo Greco

06:51 2025-04-18 UTC+2

883

- Technical analysis of EUR/USD, GBP/USD, Gold and Bitcoin

Author: Sebastian Seliga

10:18 2025-04-18 UTC+2

868

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-18 UTC+2

853

- Donald Trump ratcheted up his criticism against Federal Reserve Chairman Jerome Powell, once again calling for an immediate interest rate cut. This renewed political pressure adds to the tensions surrounding the Fed

Author: Ekaterina Kiseleva

12:09 2025-04-18 UTC+2

853

- Intraday Strategies for Beginner Traders on April 18

Author: Miroslaw Bawulski

06:52 2025-04-18 UTC+2

838