Veja também

10.03.2025 05:35 AM

10.03.2025 05:35 AMThe EUR/USD currency pair continued its upward trend throughout Friday. This time, the market had solid reasons to sell the dollar. However, it's important to note that last week, the market was already heavily offloading the U.S. currency on both days with valid reasons and days without any clear justification. As previously mentioned, one of the main contributors to the dollar's decline has been Donald Trump and his series of executive orders imposing import tariffs. While this is indeed a reason for the dollar's weakening, it may not be entirely objective.

Currently, the market is anticipating a slowdown in the U.S. economy and a significant deterioration in relations between the U.S. and several other countries. Under these circumstances, few would be inclined to buy the dollar or invest in the American economy. What worries market participants is not merely Trump's policies, but rather his unpredictability. The U.S. president could make decisions that might leave investors unable to exit from the dollar, U.S. stocks, and other assets in time. Consequently, traders and investors are opting to avoid engaging with such a risky currency at the moment.

The U.S. economy has not yet started to decline or slow down. The labor market remains stable, and inflation is still rising. Therefore, the Federal Reserve still has no reason to cut interest rates, as Fed Chair Jerome Powell explicitly stated on Friday. However, the market did not believe him. Powell acknowledged that the new U.S. policies will undoubtedly impact the economy but emphasized that it is too early to draw conclusions. He admitted that economic conditions could deteriorate and monetary policy could be eased more rapidly, but any decisions would depend on how the economy responds to the new conditions. Yet, as we mentioned earlier, the market does not want to wait for things to worsen—it wants to protect itself in advance.

As a result, the U.S. dollar, which seemed to have no alternative but to strengthen just a week ago, now looks highly uncertain. The macroeconomic background has barely changed, but the dollar continues to fall, driven purely by market expectations. What did we learn last week that could have pushed EUR/USD higher? That the European economy grew by 0.2% in Q4 instead of 0.1%? That Nonfarm Payrolls came in 10,000 below forecasts? That inflation in the Eurozone slowed to 2.4% instead of 2.3%?

There were several strong factors supporting the dollar recently. For instance, the European Central Bank cut key interest rates and indicated that it would not pause further easing. Additionally, the U.S. ISM Services PMI exceeded expectations, and Jerome Powell confirmed that the Federal Reserve plans to maintain its current monetary policy, which does not anticipate more than two rate cuts this year. Despite these factors, the dollar fell by 500 pips, and the notion of dollar strength was completely absent last week.

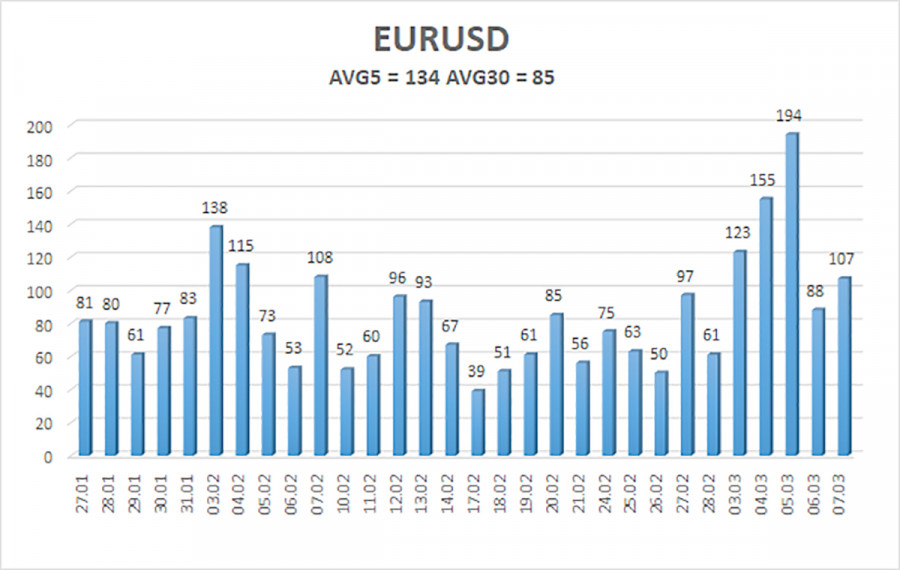

The average volatility of the EUR/USD pair over the last five trading days stands at 134 pips as of March 10, which is classified as "high." We expect the pair to move between 1.0700 and 1.0968 on Monday. The long-term regression channel has turned upward, but the overall downtrend remains intact according to higher time frames. The CCI indicator dipped into oversold territory again, signaling another wave of upward correction.

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

R1 – 1.0864

R2 – 1.0986

The EUR/USD pair has exited its sideways range and continues rising rapidly. In recent months, we have consistently stated that we expect the euro to decline in the medium term, and nothing has changed. The dollar still has no fundamental reason for a sustained downtrend—except for Donald Trump. Short positions remain much more attractive, with initial targets at 1.0315 and 1.0254, but it is extremely difficult to predict when this relentless rise will end. If you trade purely on technicals, long positions can be considered if the price remains above the moving average, with targets at 1.0864 and 1.0968. However, any upward movement is still classified as a correction on the daily time frame.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O par GBP/USD foi negociado em alta na quinta-feira, permanecendo próximo às máximas de três anos. Apesar do forte rali da libra esterlina nos últimos meses, correções ainda são raras

O par EUR/USD continuou a ser negociado de forma calma na quinta-feira, embora a volatilidade tenha permanecido relativamente alta. Nesta semana, o dólar americano apresentou alguns sinais de recuperação

O presidente dos EUA, Donald Trump, comentou mais uma vez sobre o presidente do Federal Reserve, Jerome Powell, expressando abertamente sua insatisfação com o ritmo dos cortes nas taxas

O início de negociações efetivas pode levar a uma queda significativa nos preços do ouro em um futuro próximo. Em artigos anteriores, sugeri que o preço do ouro — anteriormente

Ferrari F8 TRIBUTO

da InstaForex

InstaForex em números

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.