Veja também

10.03.2025 04:34 PM

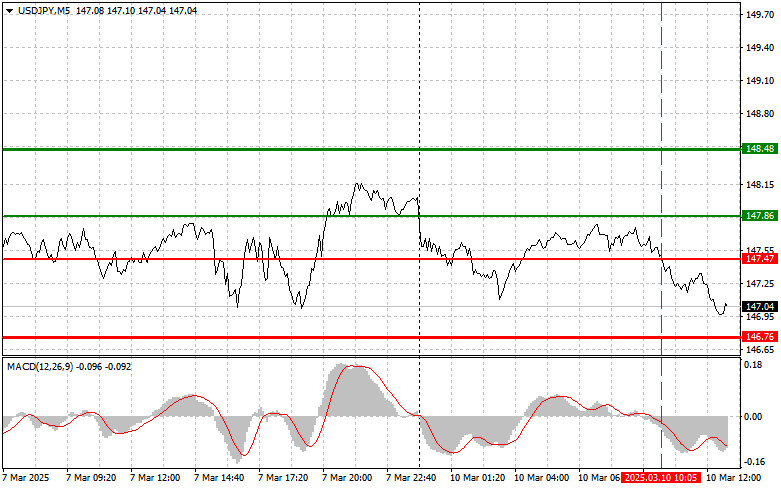

10.03.2025 04:34 PMThe test of the 147.47 level occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the dollar and missed a good downward move in the pair.

Today, there are no economic reports from the U.S., meaning nothing will prevent further selling of the dollar ahead of the expected interest rate hike in Japan. However, be cautious and avoid selling at the daily low. It is best to sell on pullbacks.

Given the anticipated tightening of monetary policy by the Bank of Japan, selling pressure on the dollar may intensify at any moment. Investors are locking in profits, creating favorable conditions for selling the dollar at local highs. However, market volatility remains a factor, and unexpected geopolitical events or statements from the White House could alter forecasts. Therefore, it is advisable to use stop-loss orders to manage potential risks.

For intraday strategy, I will focus on Scenario #1 and Scenario #2.

Buy Signal

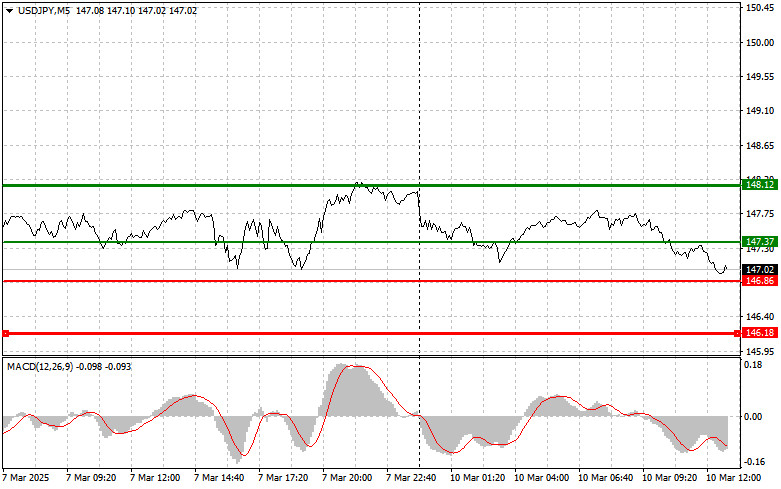

Scenario #1: Buying USD/JPY is possible at 147.37 (green line on the chart), with a target of 148.12. At 148.12, I plan to exit long positions and sell the pair for a 30–35 point pullback. The pair's rise is expected as part of a short-term upward correction.Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I will also consider buying USD/JPY if there are two consecutive tests of the 146.86 level, while the MACD indicator is in the oversold zone. This will limit the downward potential and trigger a reversal to the upside, targeting 147.37 and 148.12.

Sell Signal

Scenario #1: Selling USD/JPY is planned if the price drops to 146.86 (red line on the chart), which would likely trigger a sharp decline. The key target for sellers will be 146.18, where I plan to exit shorts and buy for a 20–25 point rebound. Selling pressure could increase at any moment.Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I will also consider selling USD/JPY if there are two consecutive tests of 147.37, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal to the downside, targeting 146.86 and 146.18.

Chart Breakdown

Important Notes for Beginner Traders

Be cautious when making trading decisions. Before major economic reports, it's best to stay out of the market to avoid sudden price fluctuations. Always use stop-loss orders to minimize potential losses. Trading without stop-losses can lead to rapidly losing your entire deposit, especially if you use large trading volumes and ignore money management principles.

A clear trading plan is essential for success. Following a structured approach, such as the one outlined above, is far more effective than making impulsive decisions based on short-term market movements.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Não houve teste dos níveis que mencionei na primeira metade do dia. Mesmo com a divulgação de dados importantes sobre a inflação no Reino Unido, a baixa volatilidade do mercado

Análise da negociação e dicas para negociar com o euro Não houve testes dos níveis que descrevi na primeira metade do dia. Mesmo com a divulgação de dados importantes sobre

O teste do nível de preço em 1,1311 ocorreu quando o indicador MACD havia acabado de iniciar um movimento descendente a partir da linha zero, confirmando um ponto de entrada

O teste do nível de preço de 1,3238 ocorreu quando o indicador MACD começou a subir a partir da linha zero, confirmando um ponto de entrada válido para a compra

O teste de preço em 142,93 ocorreu quando o indicador MACD começou a se mover para baixo a partir da marca zero, confirmando um ponto de entrada válido para

Análise das operações e dicas para negociar o Iene japonês O teste do nível 143,25 ocorreu justamente quando o indicador MACD havia começado a se mover para cima a partir

Análise da operação e dicas para negociar a libra esterlina O teste do nível de 1,3225 ocorreu exatamente quando o indicador MACD começou a subir a partir da linha zero

Análise da operação e dicas para negociar o euro O teste do nível de preço de 1,1336 ocorreu quando o indicador MACD já havia se deslocado significativamente abaixo da linha

O teste do nível 142,69 ocorreu quando o MACD já havia se deslocado significativamente abaixo da linha zero, o que limitou o potencial de queda do par. Por esse motivo

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.