Veja também

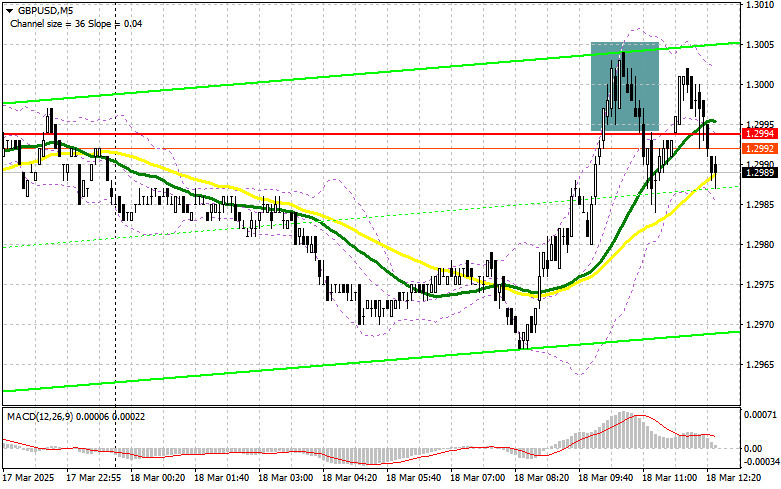

In my morning forecast, I focused on the 1.2994 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. A rise and a false breakout around 1.2994 provided a good entry point for selling the pound. However, as seen on the chart, there was no significant decline. The technical outlook for the second half of the day has been revised.

The pound continued its growth due to the lack of any economic data from the UK, just as it had throughout the previous week. Today was no exception. However, after updating the weekly high, buyers slowed down, signaling caution ahead of tomorrow's Federal Reserve meeting and the Bank of England meeting on Thursday.

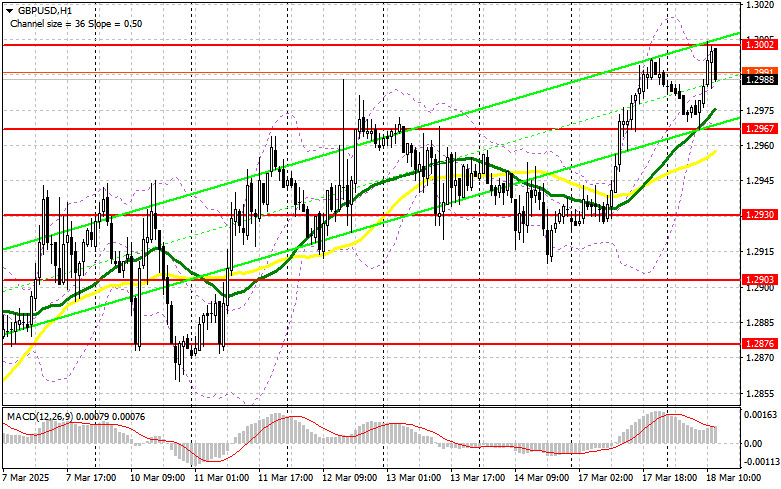

During the U.S. session, housing market data, including building permits, housing starts, and industrial production changes, will be released. Only very strong figures can pressure the pound. Given the bullish trend, the best strategy is to buy on corrections from the nearest support at 1.2967, which formed during the first half of the day. A false breakout at this level will provide a good entry point for long positions, aiming for a recovery towards 1.3002 (weekly high). A break and retest of this level from above will confirm the validity of long positions, targeting 1.3035, strengthening the bullish market. The final target will be 1.3068, where I plan to take profits.

If GBP/USD declines and lacks bullish activity around 1.2967, pressure on the pound will increase, though it is unlikely to significantly impact bullish prospects. In this case, a false breakout at 1.2930 would be a suitable condition for opening long positions. If the price falls further, I will buy GBP/USD from support at 1.2903, expecting a 30-35 point intraday rebound.

Sellers are attempting to act, but there are no strong drivers for active selling yet. In the second half of the day, the focus will shift to defending resistance at 1.3002, which will likely be tested if U.S. data disappoints. A false breakout at this level will provide a selling opportunity, aiming for a drop to 1.2967, where the moving averages currently favor bulls.

A break and retest of 1.2967 from below will trigger stop-loss orders, opening the way to 1.2930, marking a significant correction. The final target will be 1.2903, where I will take profits. Testing this level could halt the bullish trend.

If demand for the pound remains strong in the second half of the day, and bears fail to defend 1.3002, I will delay selling until a test of 1.3035, entering short positions only after a failed consolidation. If GBP/USD fails to move lower from there, I will look for short positions from 1.3068, targeting a 30-35 point pullback.

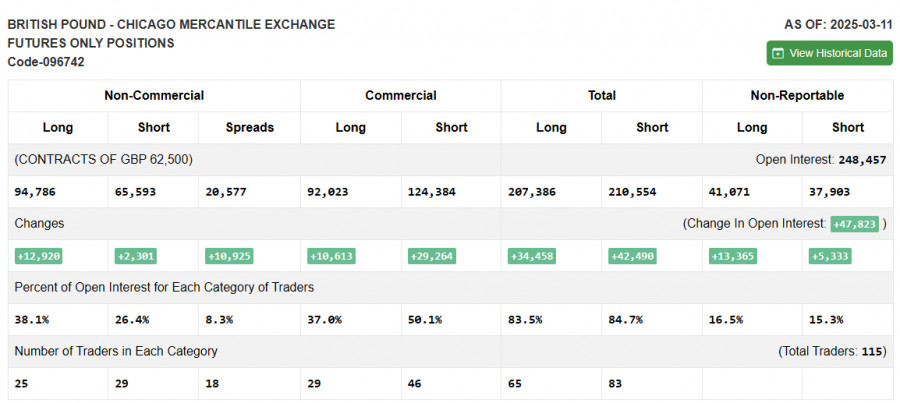

The COT report from March 11 showed an increase in both long and short positions, but long positions increased significantly more, strengthening the bullish advantage for the pound. This is also reflected in the GBP/USD chart.

Given the positive trends in the UK economy and the Bank of England's gradual approach to rate cuts, GBP/USD is likely to continue its growth. The upcoming Federal Reserve meeting could weaken the U.S. dollar further, meaning pound buyers have little to worry about. However, corrections remain possible before updating local highs.

The COT report showed that long non-commercial positions increased by 12,920 to 94,786, while short non-commercial positions added only 2,301, reaching 65,593. As a result, the gap between long and short positions expanded by 10,925 in favor of buyers.Moving Averages: The pair is trading above the 30 and 50-period moving averages, indicating further upward potential for GBP/USD.

Bollinger Bands: If the pair declines, support will be found at the lower boundary of the indicator at 1.2967.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Gráfico de Forex

Versão-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.