Veja também

28.03.2025 08:15 AM

28.03.2025 08:15 AMThe euro and the pound have shown that no one is ready for a major sell-off. However, there was no active support from big market participants positioned for long positions in risky assets either.

As a result, during the U.S. session, the dollar posted gains, recovering from earlier losses. The market interpreted the released data as a confirmation of the U.S. economy's stability, which reduces the likelihood of a sharp rate cut by the Federal Reserve. The upward revision of Q4 GDP indicates that economic activity in the United States remains relatively high level. This may ease concerns about an impending recession and support the Fed's current stance on interest rates.

Today could bring renewed pressure on the euro, and the reason for such a development lies in the upcoming release of a series of macroeconomic indicators from Germany. The first act of this economic drama will be the publication of the GfK consumer climate index, a forward-looking indicator that is highly sensitive to household sentiment and, consequently, to their willingness to spend. Weak readings from this index may signal broader issues in the economy.

The climax will be the release of data on the change in the number of unemployed people in Germany and the overall unemployment rate. A rise in jobseekers, combined with an increase in the unemployment rate, could seriously undermine confidence in the German economy's resilience, which is Europe's economic engine. Such data may trigger a wave of euro selling as investors reassess the region's growth outlook and anticipate a more dovish stance from the European Central Bank.

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly (higher or lower) from expectations, the Momentum strategy is preferred.

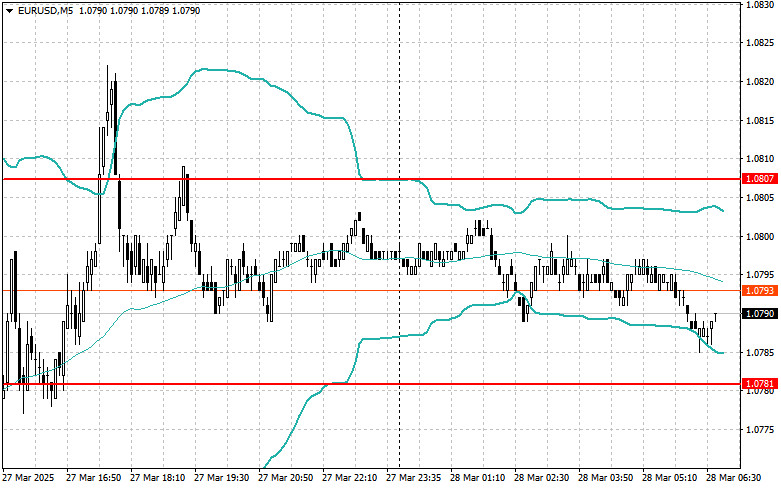

Buying on a breakout of the 1.0795 level could lead to a rise toward 1.0836 and 1.0852.

Selling on a breakout of 1.0770 could lead to a decline toward 1.0736 and 1.0700.

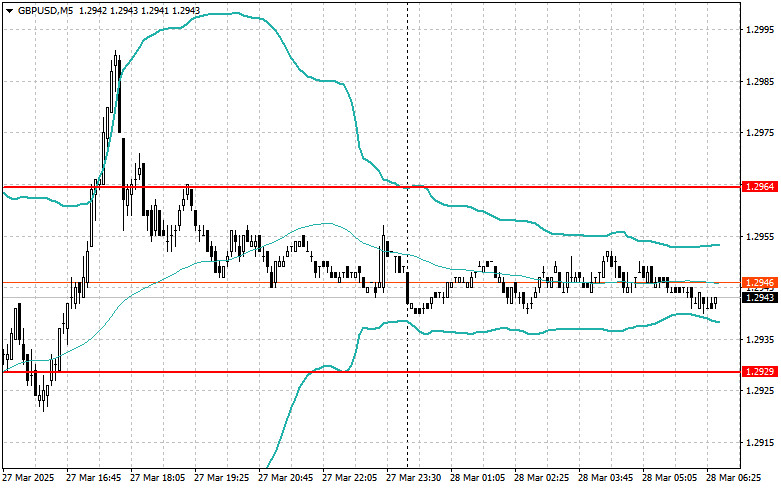

Buying on a breakout of 1.2960 could push the pound toward 1.2988 and 1.3020.

Selling on a breakout of 1.2935 could lead to a decline toward 1.2910 and 1.2890.

Buying on a breakout of 151.05 could push the dollar toward 151.35 and 151.75.

Selling on a breakout of 150.70 could trigger a decline toward 150.50 and 150.18.

I will look to sell after a failed breakout above 1.0807 on a return below that level.

I will look to buy after a failed breakout below 1.0781 on a return back above that level.

I will look to sell after a failed breakout above 1.2964 on a return below that level.

I will look to buy after a failed breakout below 1.2929 on a return back above that level.

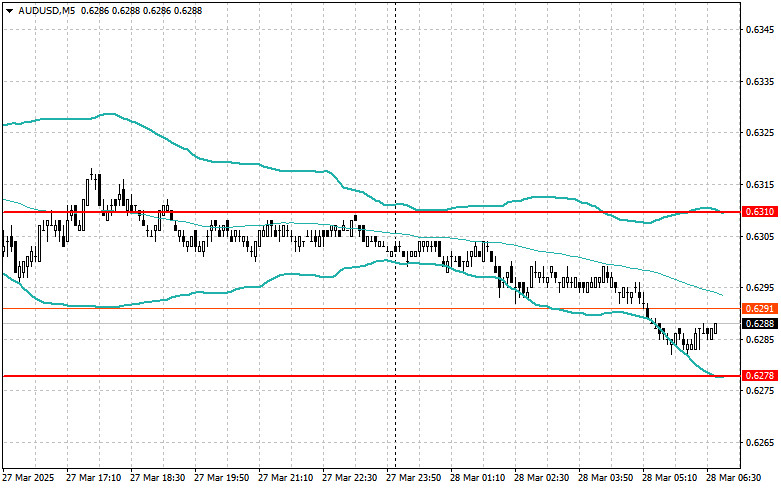

I will look to sell after a failed breakout above 0.6310 on a return below that level.

I will look to buy after a failed breakout below 0.6278 on a return back above that level.

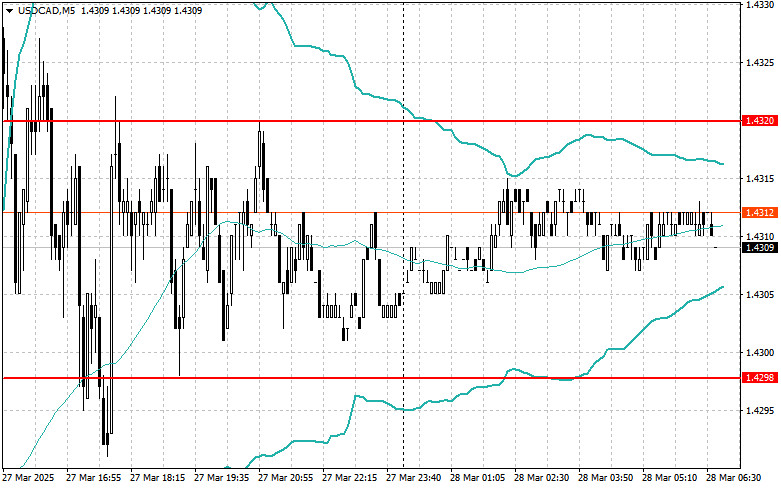

I will look to sell after a failed breakout above 1.4320 on a return below that level.

I will look to buy after a failed breakout below 1.4298 on a return back above that level.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O euro e a libra esterlina conseguiram resistir à renovada pressão vendedora, chegando até a recuperar parte de suas posições durante a sessão asiática desta quinta-feira. Na véspera, Donald Trump

O teste do nível de 147,13 ocorreu exatamente quando o indicador MACD começou a subir a partir da linha zero, confirmando um ponto de entrada válido para a compra

Análise das operações e dicas para a libra esterlina O teste de preço em 1,2882 ocorreu no momento em que o indicador MACD havia acabado de iniciar um movimento descendente

Análise e recomendações de negociação para o euro O teste de preço de 1,0975 ocorreu quando o indicador MACD tinha acabado de começar a se mover para baixo a partir

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.