NZDHKD (New Zealand Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

24 Mar 2025 16:14

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The NZD/HKD pair is a cross rate against the US dollar, which means that the two currencies in the pair are valued against USD. Although the US dollar is not present in this trading instrument, it has a significant impact on the pair. This can be seen by combining the trading charts of the two currency pairs, NZD/USD and USD/HKD.

Principal features

New Zealand is a country with a fairly strong economy. It is one of the world's largest exporters of agricultural products, wool, and wool products. The main trading partners of the country are the United States, Australia, and the Asia-Pacific region. Therefore, when analyzing the NZD/HKD pair, do not forget to monitor the economic indicators of these regions.

Hong Kong (a special administrative region of China) has a highly developed free-market economy characterized by low taxation. It is governed under the principle of positive non-interventionism. Hong Kong ranks among the top global financial hubs. In Asia, it has no equal in this regard. Besides, one of the world’s largest stock exchanges is based in Hong Kong.

Hong Kong's economy is services-oriented. Its main source of income is services as well as re-exports from China. In addition, the tourism industry is one of the major pillars of its economy. However, Hong Kong is not blessed with abundant mineral and food resources.

The Hong Kong dollar is pegged to the US currency and trades at a tight band at around 7.78 HKD per USD.

How to trade NZD/HKD

In comparison to such major currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY, this trading instrument is relatively illiquid. Therefore, when making projections, you should primarily focus on currency pairs that include the US dollar along with each currency under consideration.

When trading cross rates, you should remember that brokers tend to set higher spreads on them (when compared to major currency pairs). Therefore, before starting to work with cross rates, you should thoroughly review all the terms and conditions a broker offers.

Trading the NZD/HKD pair requires taking into account the economic indicators of both New Zealand and Hong Kong. Besides, it is necessary to monitor the economic situation in the countries that are New Zealand's main trading partners, especially in the United States.

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

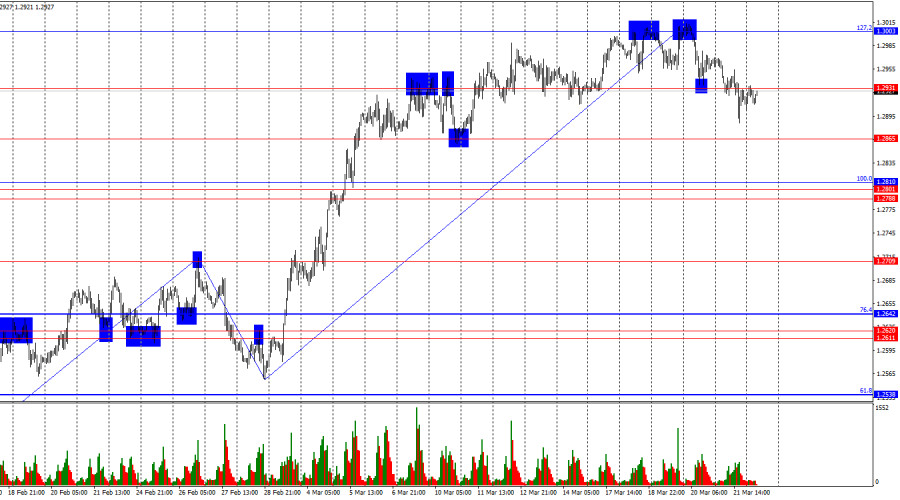

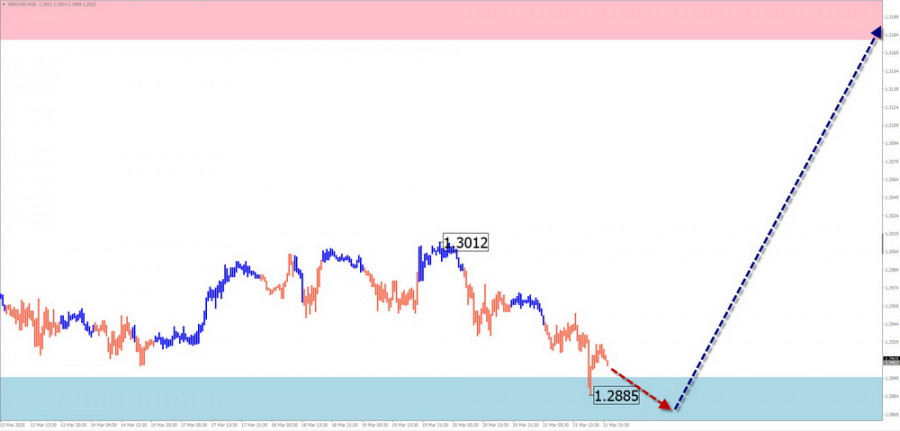

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

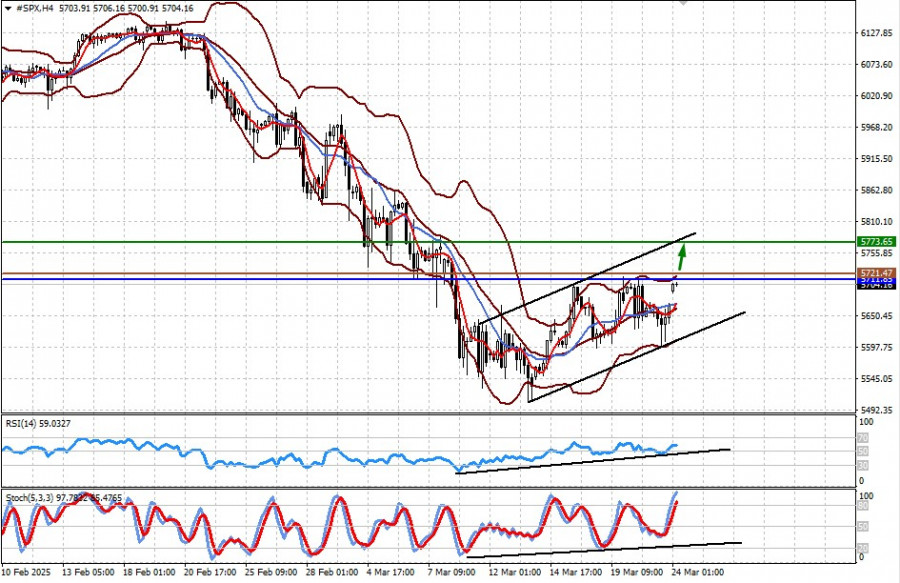

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

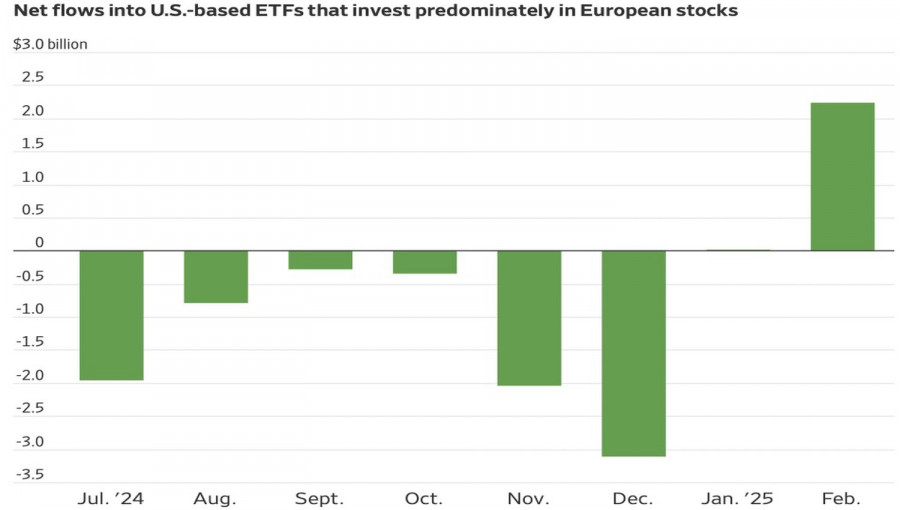

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

643

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

643