SGDJPY (Singapore Dollar vs Japanese Yen). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

SGD/JPY currency pair (Singapore Dollar vs Japanese Yen)

SGD/JPY is not a widely used currency pair on the Forex market. SGD/JPY is a cross rate against the U.S. dollar. Although the U.S. dollar does not appear obviously in this currency pair, it still exerts a significant influence on it. One can see that when the two charts are combined: USD/JPY and USD/SGD. By joining these two charts into one, you can get an approximate SGD/JPY chart.

The U.S. dollar has a big impact on both currencies. Therefore, it is essential to take into account the main U.S. economic data for the accurate forecast of a future rate of this financial instrument. These data include: the discount rate, GDP, unemployment, new vacancies and many others. Besides, it should be noted that the currencies under consideration could respond to changes in the U.S. economy at a various pace. Thus, the SGD/JPY currency pair can be used as a specific indicator of any changes in these currencies.

Singapore is a well-developed industrial country with a high level of the economic advance and living standards. Impressive economic results of the country are determined by its beneficial geographical position at the crossroads of vital shipping routes, which allow Singapore to carry on an active business with all the powerful states of the world. Nowadays Singapore's export sales primarily include: home electronics & hi-tech devices, pharmaceuticals, shipbuilding items; it also provides services in the area of finance. The economy of the country and its national currency rely heavily on export sales.

Singapore is one of the state-of-the-art countries of Asia. That is why it belongs to the group of so-called "Asian tigers", with the rapid development of its economy that is equal to affluent western countries such as the USA, Germany, France, Great Britain, etc.

The SGD/JPY currency pair is quite vulnerable to a variety of huge political events and economic trends taking place in the world. As a result, the price chart for this currency pair is hardly predictable, and it frequently goes in the opposite direction despite any analysis.

Novices are not recommended to begin their trading experience on the foreign exchange market with this currency pair. In order to trade this financial instrument successfully, you have to keep in mind lots of nuances of price fluctuations.

If you trade cross rates, you have to be aware of the fact that brokers usually set a higher spread on this pair than on more popular currency instruments. So, before you start working with the cross rates, you have to investigate the conditions offered by the broker to deal with this particular trading instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

1783

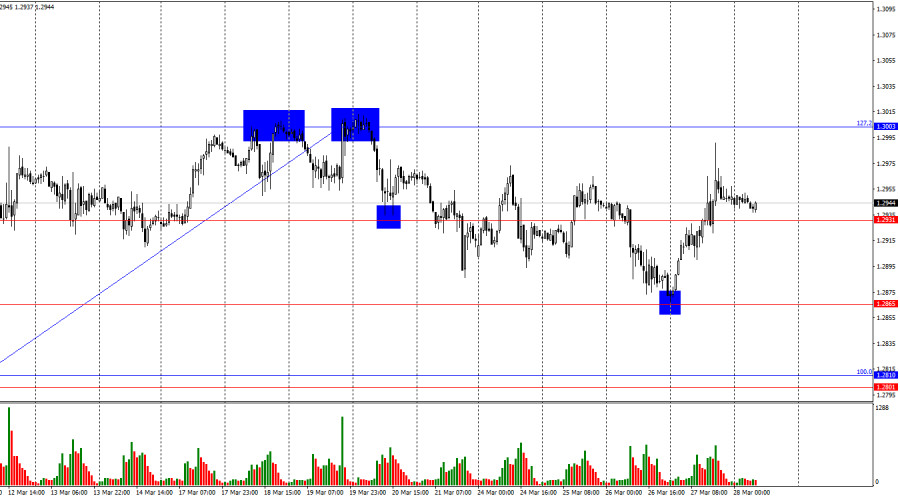

Bulls have been attacking for two weeks, but they've run out of steamAuthor: Samir Klishi

11:48 2025-03-28 UTC+2

1528

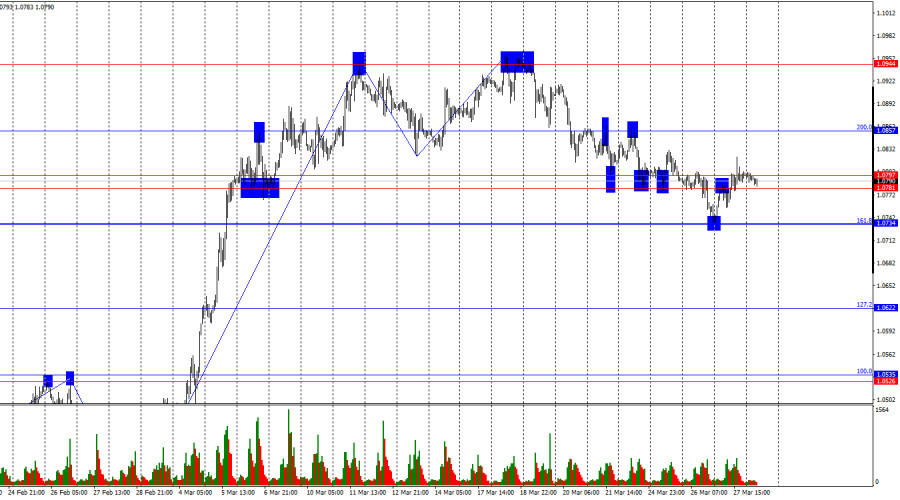

The EUR/USD pair rose by 60 basis points over the course of Thursday.Author: Chin Zhao

20:10 2025-03-28 UTC+2

1483

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1468

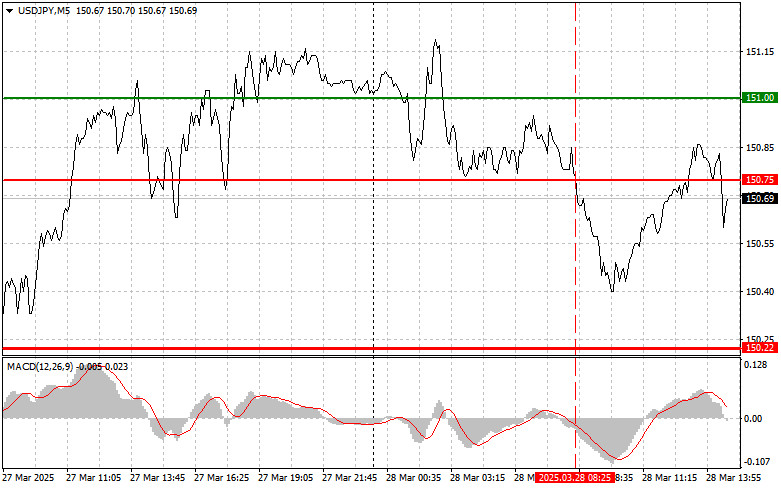

USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:04 2025-03-28 UTC+2

1288

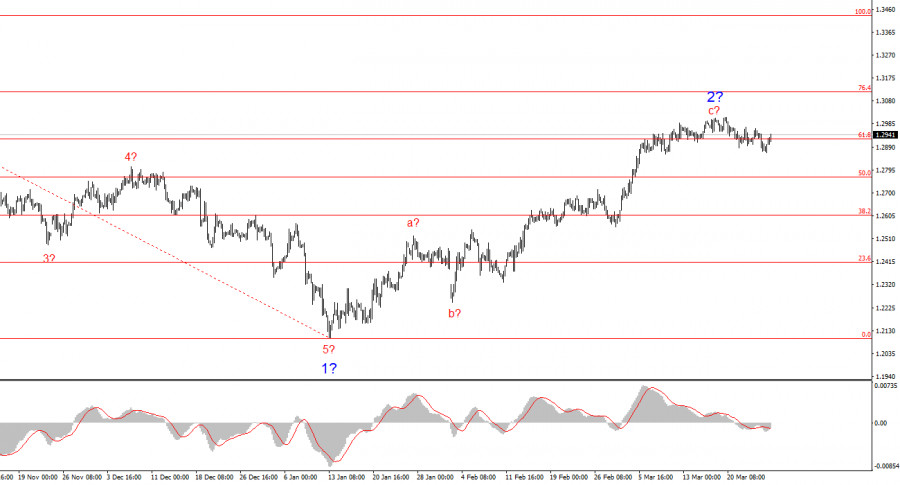

The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.Author: Chin Zhao

20:07 2025-03-28 UTC+2

1273

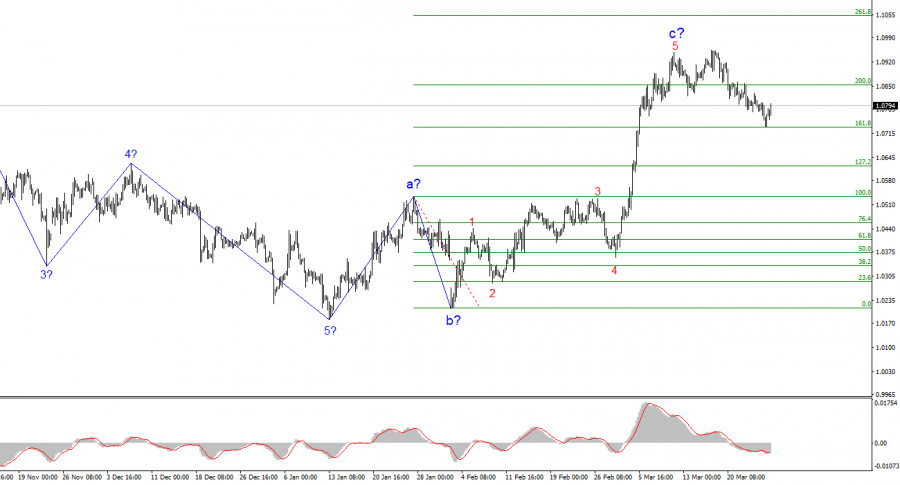

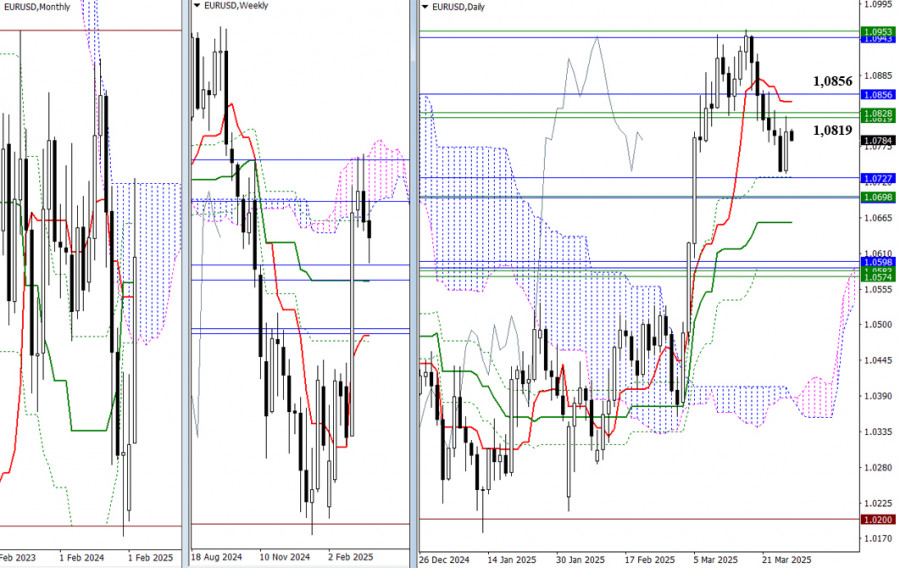

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1258

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1228

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

1213

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

1783

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1528

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

1483

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1468

- USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:04 2025-03-28 UTC+2

1288

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1273

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1258

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1228

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

1213