Vea también

31.05.2022 09:50 AM

31.05.2022 09:50 AMToday is the last day of the month. Traders should always give special attention to the close of the month and/or week since market participants are fighting intensively to set their closing price. Let's discuss the outlook for the EUR/USD pair a bit later and turn to fundamental factors first. It seems that the story of the COVID-19 pandemic ends right in the place where it started, namely in China. Shanghai has become the recent spot of the COVID-19 outbreak. It should be noted that China's authorities did well in coping with the crisis as the number of infected people is steadily declining. So, the lockdown restrictions in Shanghai will be lifted tomorrow, and the city will get back to normal life. The situation is slightly worse in some other regions of China although it is still not critical.

In the economic calendar, then data on the eurozone consumer price index and the house price index in the United States can affect the trajectory of the most popular currency pair on Forex. Later in the day, the US will publish the consumer confidence index which is much more significant than the housing data. Amid high inflation and attempts to tackle it, the CPI data in the eurozone will be of particular importance. If prices rise above the estimated readings, the number of supporters of the hawkish monetary policy among the ECB officials may considerably increase. In this case, ECB President Christine Lagarde will have to change her rhetoric and start raising the rates in the near term.

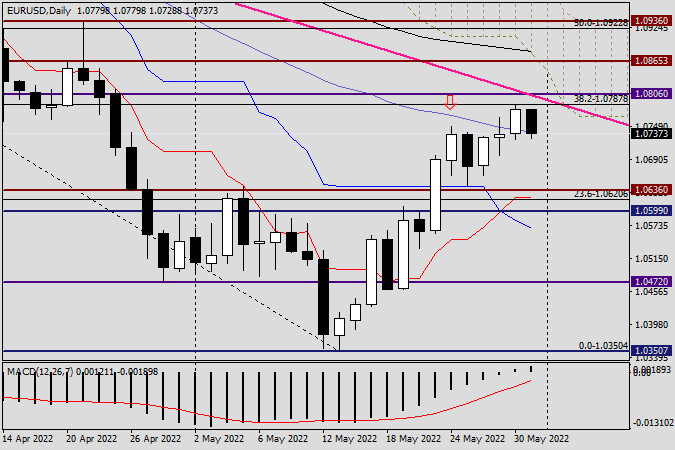

Daily chart

Now let's analyze the EUR/USD chart. As expected, the euro/dollar pair closed yesterday's session with growth. The euro bulls finished the session above the blue 50-day simple moving average but faced resistance at the 38.2 Fibonacci level of the grid stretched in the descending channel of 1.1495-1.0350. At the moment of writing, the pair is actually declining in a pullback towards the 50-day MA that was tested yesterday. It would be ideal for the bulls to close this month above the level of 1.0800. Yet, given the current market sentiment, it will be quite difficult to fulfill due to the strong resistance found at 1.0800. In addition to the 50-day MA and the 38.2 Fibo level, there is also a pink resistance line found at 1.1495-1.1185. EUR/USD is set to close the May session with growth but the closing price of the month will be the most important factor. The US employment data expected on Friday may weaken the dollar and send the pair well above 1.0800 or even higher. But let's let wait until Friday.

You are probably waiting for recommendations on how to trade the euro/dollar pair. In my opinion, the main strategy for now is to buy the pair on corrective pullbacks to the levels of 1.0733, 1.0700, and 1.0675. I think it is already too late to go short on the pair as it has considerably declined. However, if the euro bulls attempt to push the quote upwards to the area of 1.0760-1.0780, bearish candlestick patterns may start to appear on lower time frames, such as H4 and H1. This will prove the weakness of the bulls who are not able to break through the resistance zone in the current conditions. This suggests a decline and selling of the pair. Many years of observation of the euro/dollar pair conducted on a daily basis showed that EUR/USD usually reverses before a true breakout of key levels or zones, thus demonstrating its weakness. But then, the price makes an accurate and rapid breakout when nobody expects it. Let's see how the pair will behave this time. Back in the day, the market would have to wait for the news release to make such a rapid breakout. In recent years, however, traders do not have patience for this, so the price starts to plan its move beforehand. In our case, we are talking about the publication of the jobs data in the US scheduled on Friday. Even the slightest decline in figures may undermine the position of the US dollar.

Good luck!

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.