Vea también

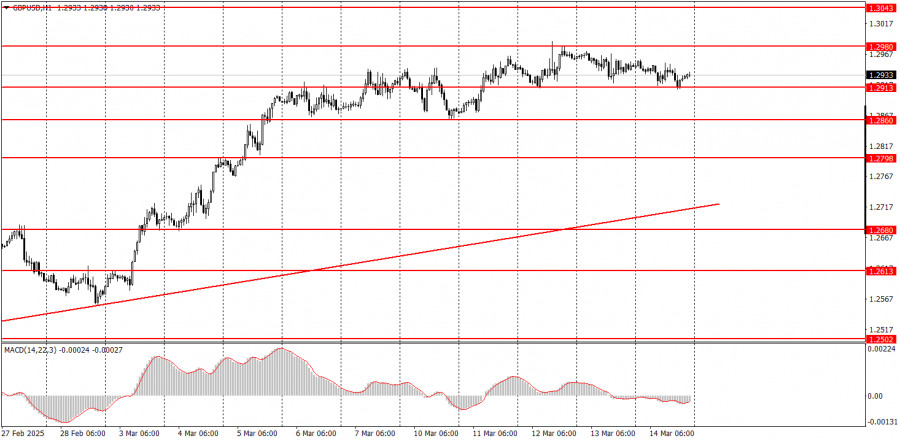

The GBP/USD pair continued to trade with low volatility on Friday, remaining within the sideways channel of 1.2913 to 1.2980. For the last four days, the price has consistently remained in this range. Despite the strong growth of the British currency, there seems to be no inclination in the market to correct, even slightly. The market has been largely ignoring any positive news for the dollar, as evidenced on Friday.

On that day, reports on industrial production and GDP were published in Great Britain, marking the first reports of the week. GDP for January came in below forecasts, and industrial production fell by 0.9%, which was worse than anticipated. However, the pound sterling did not decline during the European trading session. This suggests that the market overlooked these reports, which would typically support the dollar. However, if Donald Trump announces new tariffs over the weekend, we could see the dollar drop on Monday.

In the 5-minute time frame on Friday, only one trading signal was generated, which could easily be ignored. Towards the end of the day, the price bounced off the level of 1.2913, but entering the market before the weekend—especially knowing that Trump could speak at any moment and potentially cause market turmoil—was not advisable.

In the hourly time frame, the GBP/USD pair should have started a downtrend some time ago, but Trump's actions seem to prevent this from happening. In the medium term, we still expect the pound to decline with a target of 1.1800. However, it is uncertain how long the dollar's downturn, influenced by Trump, will last. Once this movement concludes, the technical situation across all time frames may change drastically, but currently, long-term trends still point downward. The pound has risen in a manner that seems excessive and illogical.

The GBP/USD may continue to rise on Monday if Trump continues to make waves in the market and impose his terms. A downward correction is impending, but the market does not currently favor buying the dollar.

On the 5-minute TF, you can now trade at 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107. There are no interesting events scheduled for Monday in the UK, while in the U.S., the retail sales report will be released. But we remember that the market does not need macroeconomic data at this time.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.