Vea también

04.04.2025 09:03 AM

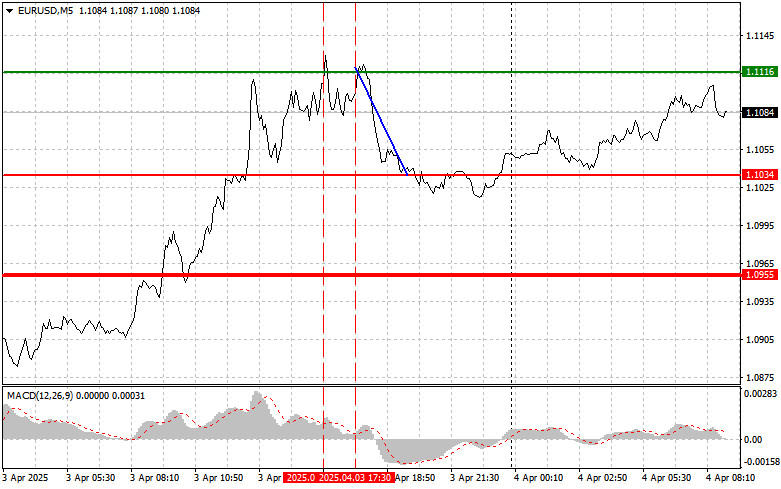

04.04.2025 09:03 AMThe price test at 1.1116 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upside potential. For this reason, I did not buy the euro. The second test of 1.1116 coincided with the MACD being in the overbought zone, which confirmed a valid entry point for a sell trade according to Scenario #2 and resulted in an 80-pip drop in the pair.

Yesterday was marked by a significant strengthening of the euro, driven by broad weakness in the U.S. dollar. This was triggered by the Trump administration's introduction of trade tariffs, which caused concern among market participants. Traders and investors lowered their forecasts for the U.S. economy, which led to a weaker dollar. Another factor that added to worries about slowing economic growth in the U.S. was the disappointing performance of the services sector. The corresponding index barely slipped below the critical 50-point mark, which would indicate stagnation in that sector.

Several economic reports will be released this morning, including data on German factory orders, Italian industrial production, and retail sales. If these data are positive, the euro will likely continue strengthening against the U.S. dollar. However, it's important to remember that other factors can also impact the currency market's dynamics. For instance, political risks in Europe or unexpected comments from European Central Bank officials could interrupt the upward trend.

Strong economic indicators from Germany and Italy will support the euro, but let's not forget that the U.S. labor market reports are ahead and will be the main focus in the second half of the day.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

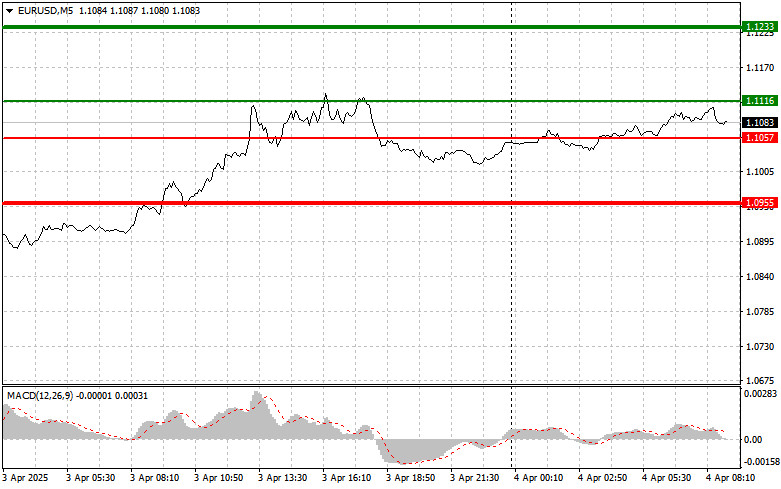

Scenario #1: I plan to buy the euro today if the price reaches around 1.1116 (green line on the chart) with a target of 1.1233. At 1.1233, I plan to exit the long position and open a sell trade in the opposite direction, aiming for a 30–35-pip move from the entry. A continuation of yesterday's upward trend can be expected in the first half of the day. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1057 level when the MACD indicator is in the oversold zone. This would limit the downside potential and lead to an upward market reversal. A rise toward the opposite levels of 1.1116 and 1.1233 can be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.1057 (red line on the chart). The target will be 1.0955, where I plan to exit the short position and immediately buy in the opposite direction, aiming for a 20–25-pip move. Downward pressure on the pair is unlikely to return today. Important! Before selling, make sure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1116 level when the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.1057 and 1.0955 can be expected.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

Análisis de las operaciones y consejos para operar con el euro. La prueba del precio 1.0282 en la segunda mitad del día coincidió con el momento en que el indicador

Análisis de las operaciones y consejos para operar con el yen japonés La prueba del nivel de precio 157.98 coincidió con el momento en que el indicador MACD había descendido

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.